MOTR Research Headlines

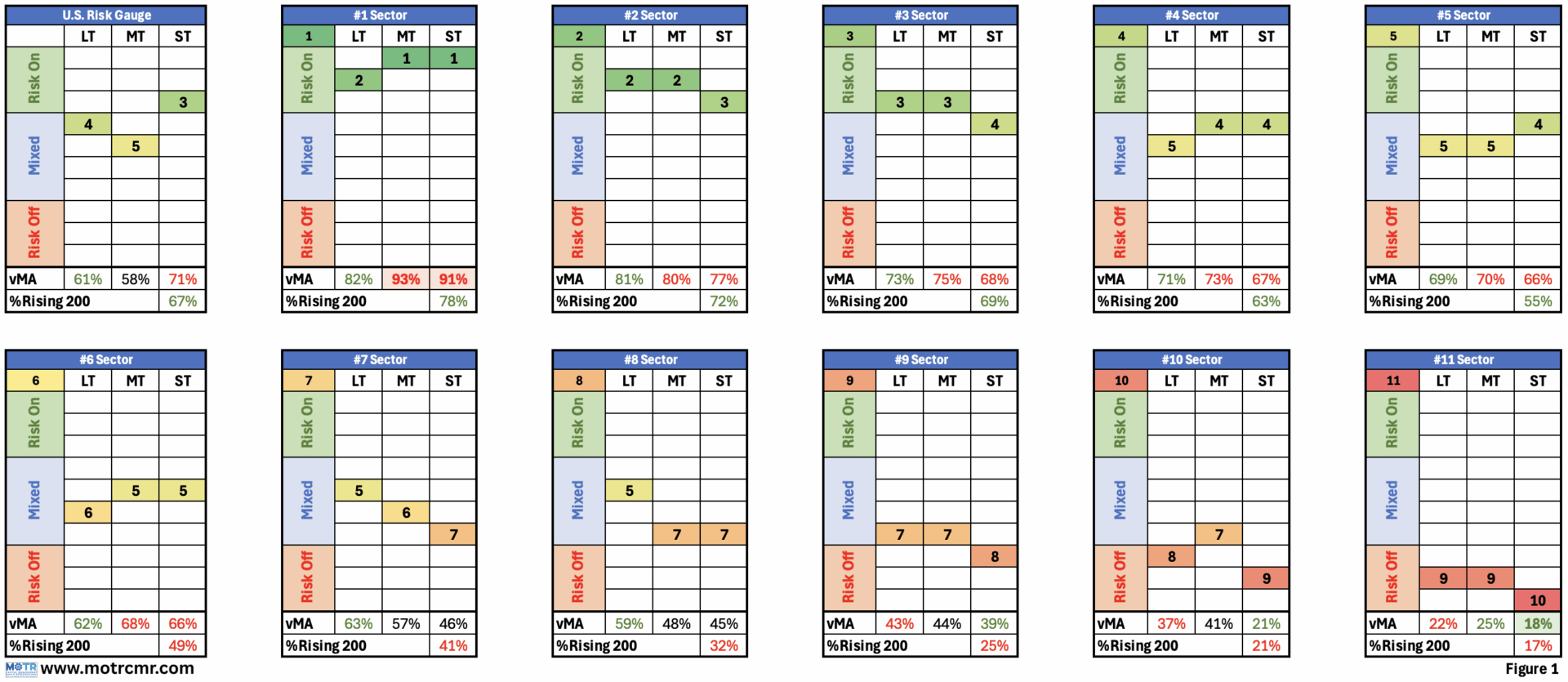

Weekly Risk Gauge (WRG): “Short-Term Joins the ‘Risk On’ Party.”

Highlights The short-term Risk Gauge has flipped to 'Risk On,' joining the long-term gauge and putting the market one step away from a fully aligned 'Risk On' environment across all time frames. Market participation is steadily improving, with 54% of stocks now trading with a rising...

Charting My Interruption (CMI): “Mo, Mo, Mo!! Merry Christmas!!”

Headlines Santa’s rally is here, but he’s flipping the script and handing out the biggest gifts to small and micro caps while mega caps get the coal. Our Risk Gauge just ticked up to Risk On in MT as well as LT, hinting that a long-awaited regime shift could be taking place. Small...

Weekly MOTR Report (WMR): “High Beta Overbought, But Confirming.”

Headlines As we ponder the potential for a Santa Claus rally to cap off the year, the Risk Gauge is staging one more effort to enter 'Risk On'. We've been here several times since the 2021 peak, but lack of real fundamental drivers has failed to compel the broad market higher. To be...

Weekly Risk Gauge (WRG): “Long-Term Risk Gauge Upticks to Risk On.”

Highlights The U.S. long-term Risk Gauge has turned 'Risk On', signaling improved market structure and keeping the focus on long-side leadership. Healthcare and Materials continue to lead, while Energy is improving but still battling long-term resistance. Staples remain the weakest...

Monthly MOTR Checkup (MMC): “Navigating Complexity with Master Oogway.”

"Navigating Complexity with Master Oogway." Another month passes by without resolution to the increasingly fragile structure percolating beneath the surface of the popular averages. For passive investors, there is little to do at this point but stay long. For active managers, however, there is...

More WMR More WRG More CMI More Monthly Video

The Weekly MOTR Report (WMR)

Weekly MOTR Report (WMR): “High Beta Overbought, But Confirming.”

Headlines As we ponder the potential for a Santa Claus rally to cap off the year, the Risk Gauge is staging one more...

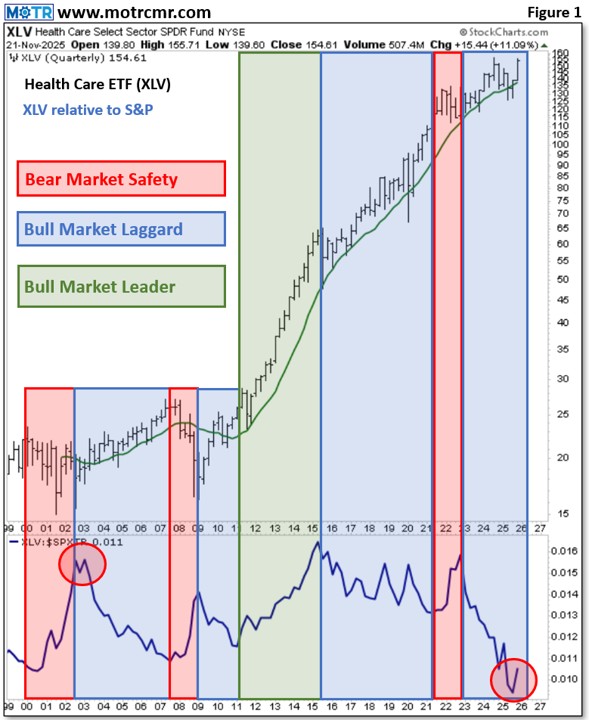

Weekly MOTR Report (WMR): “Health Care Next Cycle’s Leadership?”

***Reminder: As per usual, following the Thanksgiving holiday weekend, there will be no WMR this week. Happy...

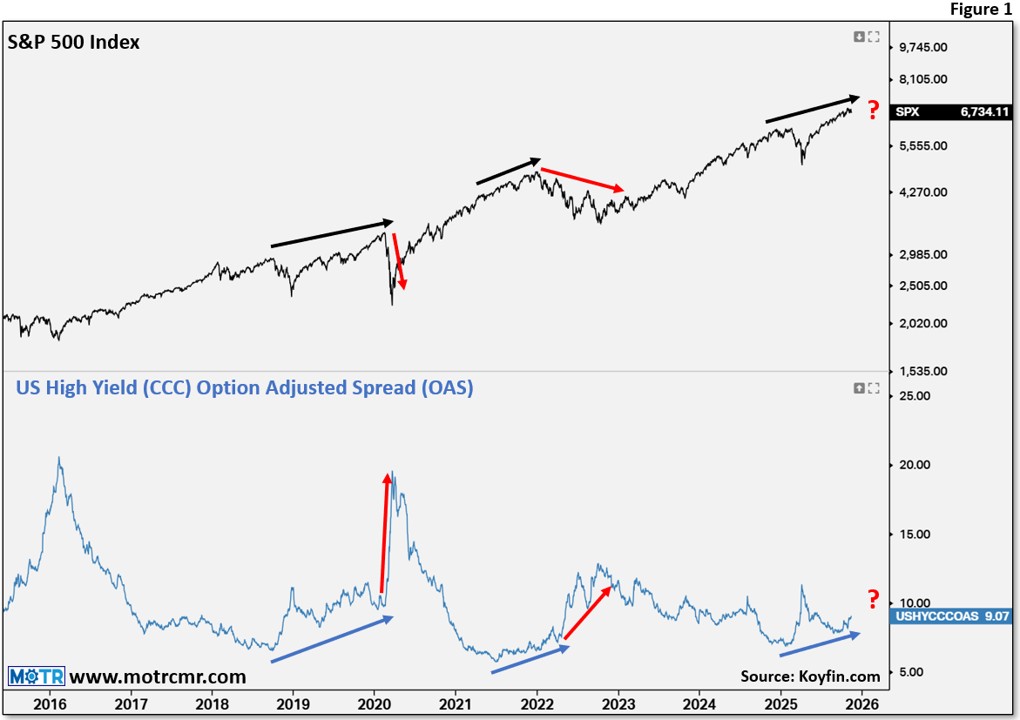

Weekly MOTR Report (WMR): “Credit Spreads Showing Stress.”

Highlights Credit spreads have been widening since early October, suggesting that Mr. Market is growing uneasy with...

Weekly Risk Gauge (WRG)

Weekly Risk Gauge (WRG): “Short-Term Joins the ‘Risk On’ Party.”

Highlights The short-term Risk Gauge has flipped to 'Risk On,' joining the long-term gauge and putting the market one...

Weekly Risk Gauge (WRG): “Long-Term Risk Gauge Upticks to Risk On.”

Highlights The U.S. long-term Risk Gauge has turned 'Risk On', signaling improved market structure and keeping the...

Weekly Risk Gauge (WRG): “Tech Oversold, Staples out of Risk Off.”

Highlights Markets sold off broadly on elevated volume following NVDA earnings, sharp swings in rate-cut expectations,...

Charting My Interruption (CMI)

Charting My Interruption (CMI): “Two Opposed Ideas, One Action Plan.”

Highlights The market continues to flash major divergences, with the S&P near all-time highs, making the ability...

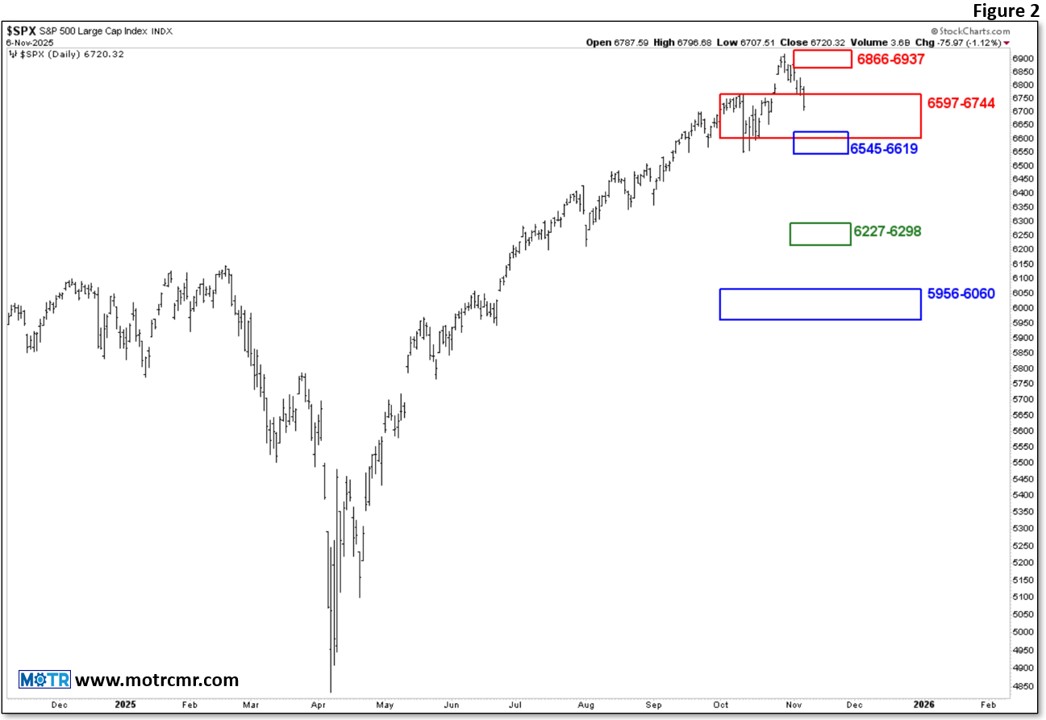

Charting My Interruption (CMI): “Getting Oversold.”

Highlights Our process leads us to a tactical exposure that is roughly balanced between longs and shorts, reflecting...

Charting My Interruption (CMI): “I’m Not Quite Dead, Sir!”

Highlights With the S&P floundering inside its overlapping projected monthly and quarterly resistance zones, it...

Monthly MOTR Checkup (MMC)

Monthly MOTR Checkup (MMC): “The Battle of Narratives–and the Need to Act.”

"The Battle of Narratives--and the Need to Act." With so many compelling, yet opposed narratives competing for our...

Monthly MOTR Checkup (MMC): “Yes, it is a bubble, and that’s a GOOD thing!”

"Yes, it is a bubble, and that's a GOOD thing!" Many long-time market veterans either struggle to identify today's...

Monthly MOTR Checkup (MMC): “Market Breadth Has Spoken.”

"Market Breadth Has Spoken." Powell's potential pivot at Jackson Hole drove a breadth surge that was enough we think to...