MOTR Research Headlines

Monthly MOTR Checkup Video (MMC): “Appear strong when you are weak and weak when you are strong.”

After spending nearly two years appearing to be strong when it was weak, the market may be transitioning to a period of appearing weak when it is indeed...

Weekly MOTR Report (WMR): “Crypto & Crypto Stocks Leading the Way.”

Highlights As the S&P takes a pause, burdened by a near -10% setback in NVDA last week, crypto and crypto stocks are shaping up rather well. Both Bitcoin and Ethereum have been basing since 2021, and after testing support, look poised to breakout again. Our Crypto Industry group is...

Charting My Interruption (CMI): “Bull Markets Still Have Corrections.”

Highlights Just because our Risk Gauges have finally achieved 'Risk On' for the first time since before the 2021 peak, that does not mean that corrections have been eradicated. Corrections are normal, and we remain bullish, as long as key Trend Support Zones remain intact. We are on the...

Weekly MOTR Report (WMR): “Robust Bull Market Finally Getting Closer.”

Highlights In Friday's CMI note, we said we needed to see an improvement in our trend model readings before spinning Thursday's violent rotation as being the precursor to a robust bull market. After updating the models this weekend, we can say that we have indeed seen adequate...

Charting My Interruption (CMI): “News Flash: Violent, Chaotic Behavior is not Bullish.”

Highlights As much as we all want to say yesterday's price action was bullish, I struggle to do so because the data (below) say otherwise. Bull markets are marked by calm, persistent behavior; bear markets are marked by chaotic, violent behavior. Yesterday was the latter. In today's...

More CMI More WMR More Monthly Video

Charting My Interruption (CMI)

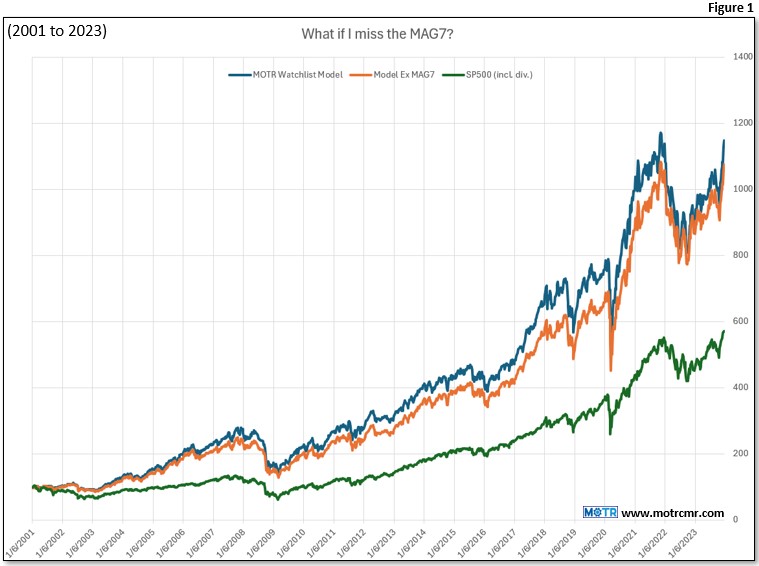

Charting My Interruption (CMI): “The Surprising Truth About Momentum & Trend Following.”

Highlights Most investors are of the impression that to do well over time as a momentum investor, one must buy the very...

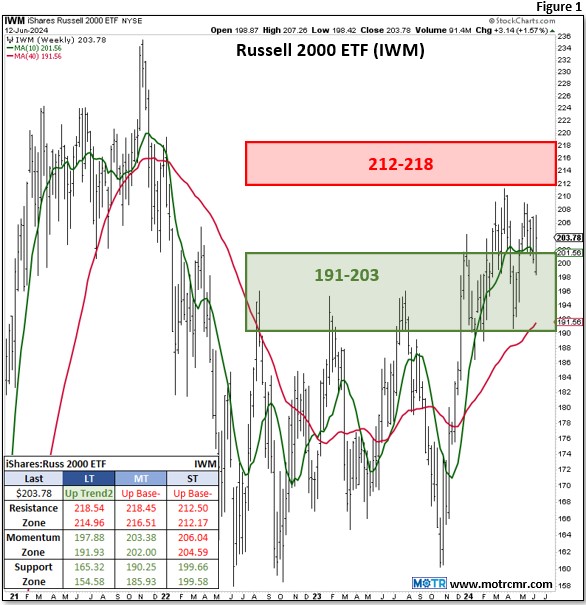

Charting My Interruption (CMI): “Small Caps off Their Highs, But Still Hopeful.”

Highlights Small caps have been an anchor around the neck of this struggling bull market since the banking crisis of...

Charting My Interruption (CMI): “Micro-caps are Bearish, but That’s Okay.”

Highlights If the market was made up of only large and mega-cap stocks, we'd label this a robust bull market. ...

The Weekly MOTR Report

Weekly MOTR Report (WMR): “Bullish, But Cautiously So.”

Highlights Market conditions continue to diverge, with leadership itself getting more and more narrow. Whether or...

Weekly MOTR Report (WMR): “The ‘Haves’ and the ‘Have-Nots’ Grow Further Apart.”

Highlights Despite the strong showing by the S&P ETF (SPY) last month (+3.4%), the average stock was actually down...

Weekly MOTR Report (WMR): “More Potholes on Backroads Than Highways.”

Highlights Since March, our commentary has been focused on the narrowing character of market breadth, and the prospects...

Monthly MOTR

Checkup Video Series

Monthly MOTR Checkup Video (MMC): “This Bull is Getting Tired.”

While market breadth has been thinning out for a while now, it is beginning to fray even within the leadership. This is not...

Monthly MOTR Checkup Video (MMC): “Market Still Not Ready For ‘Prime’ Time Yet.”

While we remain longer-term bullish, and it is wonderful that the S&P has recorded new highs, market breadth has yet to...

Monthly MOTR Checkup Video (MMC): “The ‘Beauty & the Beast’ of Trend Following.”

Corrections are a necessary evil of healthy uptrends--they reset expectations, and flush out bullish sentiment, setting the...