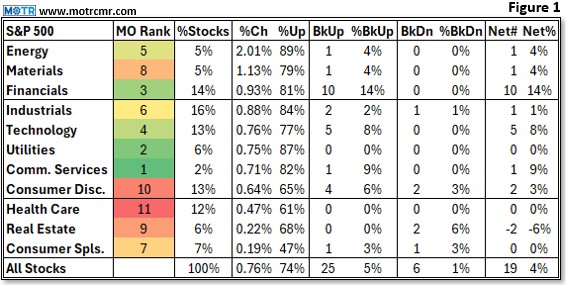

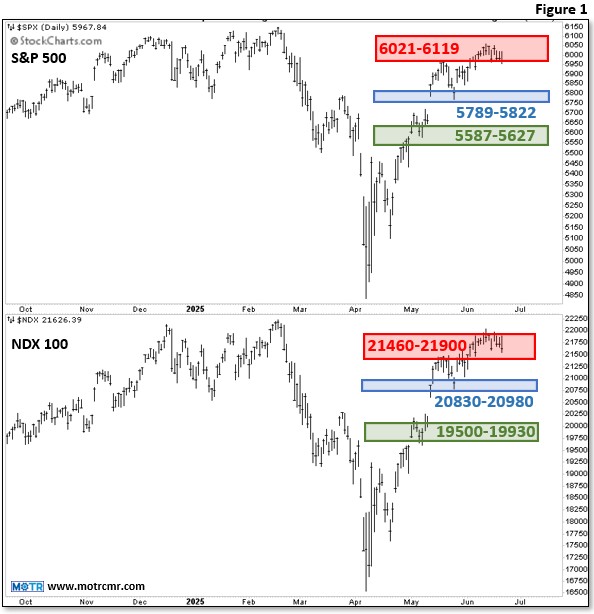

While we remain longer-term bullish, and it is wonderful that the S&P has recorded new highs, market breadth has yet to confirm the S&Ps strength. This leaves us with a tactically cautious view, and a strong preference for buying only when the market is oversold. We are now overbought, so we prefer to adopt a "wait and see" attitude. Continue to "water the flowers and pull the weeds", of course, but resist the temptation to get overly bullish while we are overbought.