Charting My Interruption (CMI): “Banking on Stability”

In recent notes, we've highlighted 4500-4700 on the S&P as an area where investors should expect to see the market

Charting My Interruption (CMI): “Another Debt Downgrade…Must Be BAD, Right?”

Highlights With news headlines running away with dire implications of another US debt downgrade, it is important to remember whose

Charting My Interruption (CMI): “It’s tough to make predictions, especially about the future.”–Yogi Berra

Most popular press outlets are surprised by the economy's recent strength. For instance, the US News & World Report featured

Charting My Interruption (CMI): “When MAANAGeMeNT Leaves the Building…”

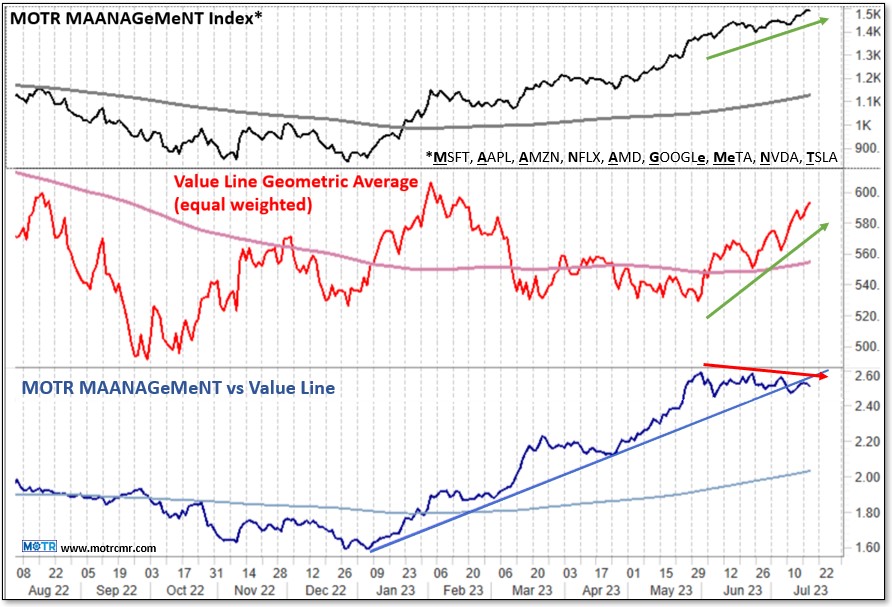

One key theme we have been highlighting as a potential change in market dynamic going forward has been the faltering

Charting My Interruption (CMI): “MAANAGeMeNT Conceding Leadership Role?”

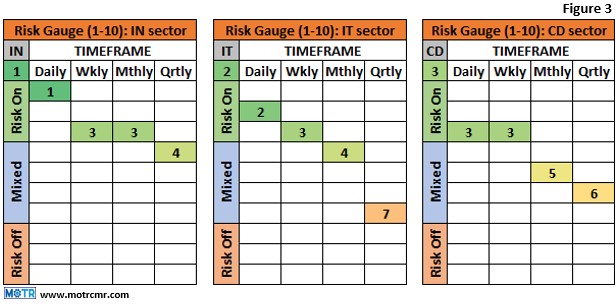

The bears might be losing the biggest datapoint in their narrative's arsenal: the breadth divergence. Our view has been that this

Charting My Interruption (CMI): “Thomas Sowell, Bull Markets & the Wisdom of Price”

Happy 93rd birthday to Thomas Sowell, one of our nation's foremost thought leaders in social science, government and economics. Mr.

Charting My Interruption (CMI): “Response to weakness matters more than the weakness itself.”

Oversold conditions don't go away when the market transitions away from a bear market environment. What does change however is

Charting My Interruption (CMI): “It’s more important to rule out a bear market than identify a bull.”

At the end of the day, the market can only do one of three things: it can go up, down,

Charting My Interruption (CMI): “The Bulls Are Baaaaack!!!”

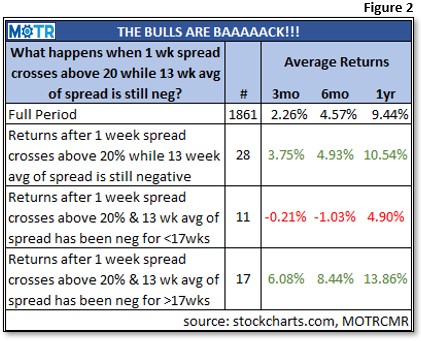

On Thursday, the spread between the percent bullish and percent bearish respondents in the weekly AAII Investor Sentiment survey exceeded

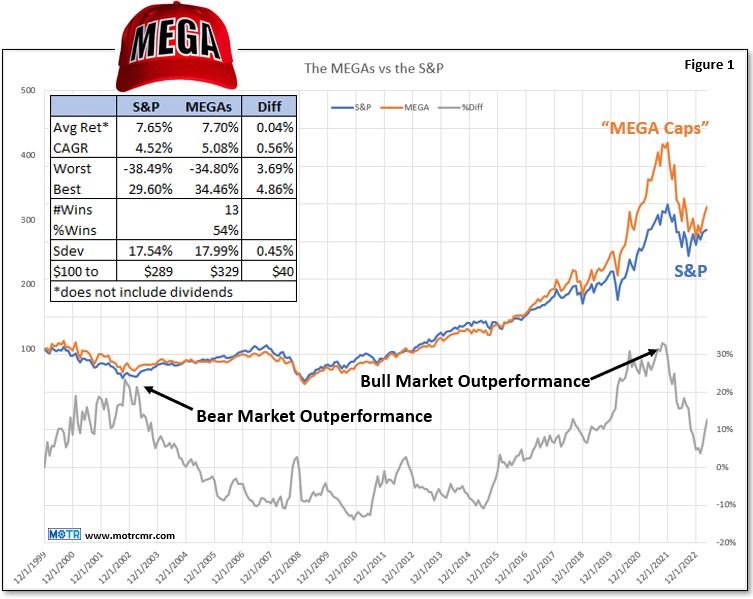

Charting My Interruption (CMI): “MEGA ‘Caps’…Making Equities Great Again!!”

The MEGA "Caps" are Making Equities Great Again!!! The 10 largest companies have been making headlines of late, as they

Charting My Interruption (CMI): “MAANAGeMeNT vs Employees…the tension grows.”

As the 9 constituents of our MAANAGeMeNT Index* (Figure 1, top panel) track ever higher in their sky-scraping office tower

Charting My Interruption (CMI): “What if interest rates turn higher?”

With the US 10 year yield having broken a 40 year downtrend, the idea that we have transitioned to a