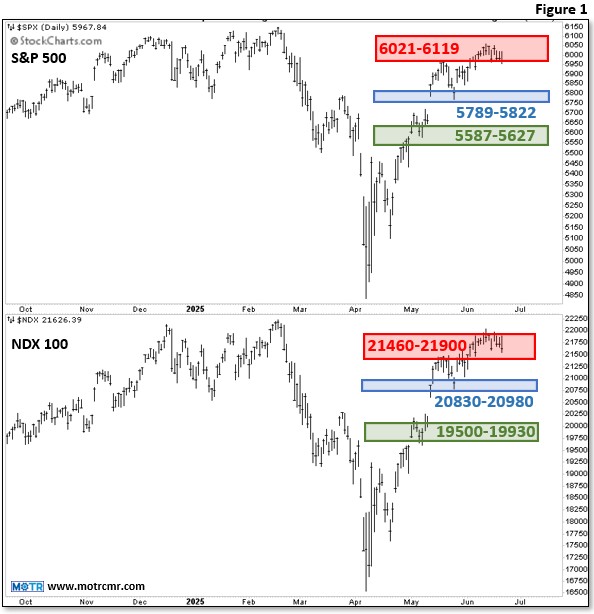

With the US 10 year yield having broken a 40 year downtrend, the idea that we have transitioned to a new interest rate regime seems like a fair conclusion. What is not clear is whether rising rates are good or bad for stocks broadly speaking.

With the US 10 year yield having broken a 40 year downtrend, the idea that we have transitioned to a new interest rate regime seems like a fair conclusion. What is not clear is whether rising rates are good or bad for stocks broadly speaking.

After the last deflationary period in the US (1930's depression era), interest rates bottomed around 1.5% on their way to roughly 15. . .