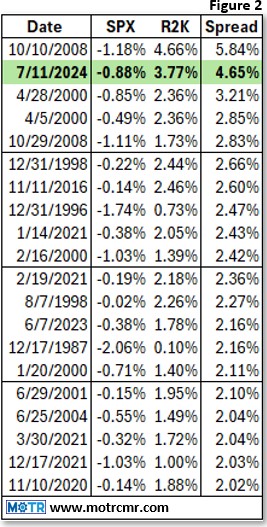

Oversold conditions don't go away when the market transitions away from a bear market environment. What does change however is the behavioral response from investors to the weakness. In other words, what happens next determines the market regime.

Oversold conditions don't go away when the market transitions away from a bear market environment. What does change however is the behavioral response from investors to the weakness. In other words, what happens next determines the market regime.

In bear markets, oversold conditions generate even more selling, as pessimism dominates the behavioral response. This results in lower lows despite, or perhaps even because. . .