Charting My Interruption (CMI): “Bull Markets Still Have Corrections.”

Highlights Just because our Risk Gauges have finally achieved 'Risk On' for the first time since before the 2021 peak,

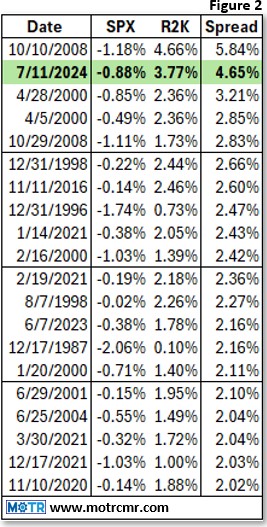

Charting My Interruption (CMI): “News Flash: Violent, Chaotic Behavior is not Bullish.”

Highlights As much as we all want to say yesterday's price action was bullish, I struggle to do so because

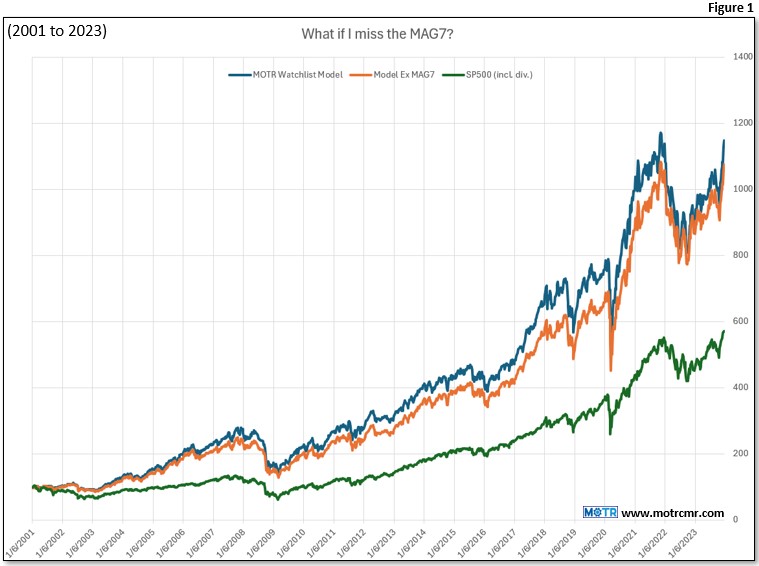

Charting My Interruption (CMI): “The Surprising Truth About Momentum & Trend Following.”

Highlights Most investors are of the impression that to do well over time as a momentum investor, one must buy

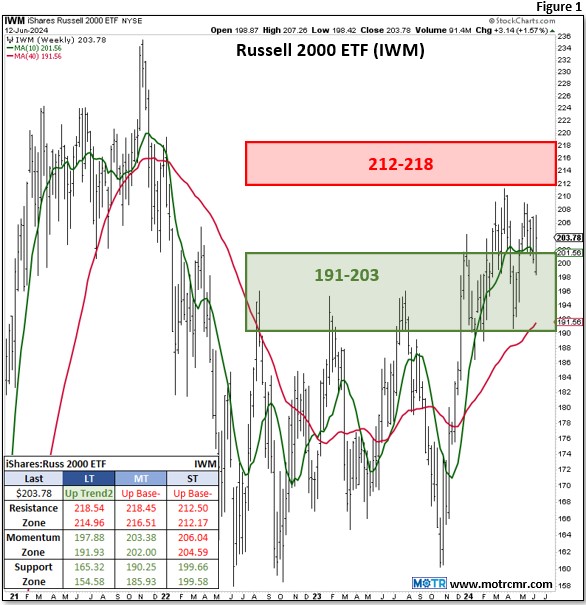

Charting My Interruption (CMI): “Small Caps off Their Highs, But Still Hopeful.”

Highlights Small caps have been an anchor around the neck of this struggling bull market since the banking crisis of

Charting My Interruption (CMI): “Micro-caps are Bearish, but That’s Okay.”

Highlights If the market was made up of only large and mega-cap stocks, we'd label this a robust bull market.

Charting My Interruption (CMI): “Market Weakness is a Feature, Not a Bug.”

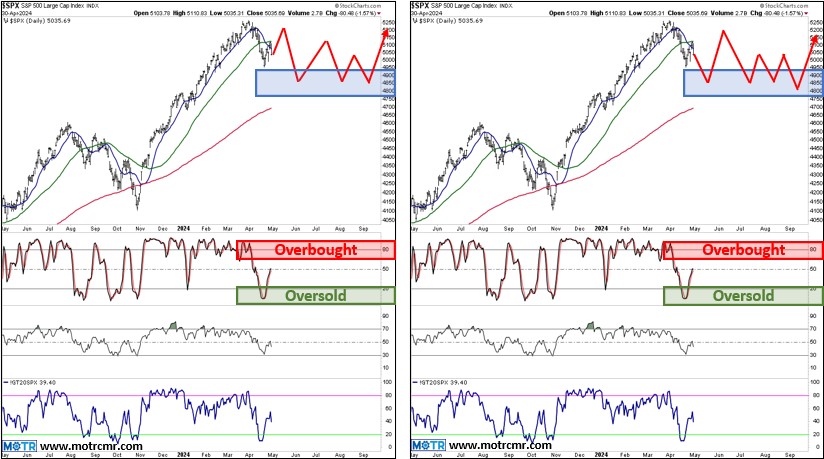

Highlights Failing to adequately repair the structural breaks recorded during the April decline, the market is once again in a

Charting My Interruption (CMI): “You’re Getting Sl-e-e-e-e-py.”

Highlights With all eyes on the NVDA pocket watch, hypnotizing investors into a state of "risk acceptance", the rest of

Charting My Interruption (CMI): “Do New Highs Mean Blue Skies?”

Highlights Although the SPY and QQQ ETFs have registered new highs, we don't see enough evidence to say we should

Charting My Interruption (CMI): “The Siren Call of Market Rallies.”

Highlights In life, and in investing, it is usually not the easy path that gets rewarded. The immediate satisfaction felt

Charting My Interruption (CMI): “Remember…Do the Opposite!”

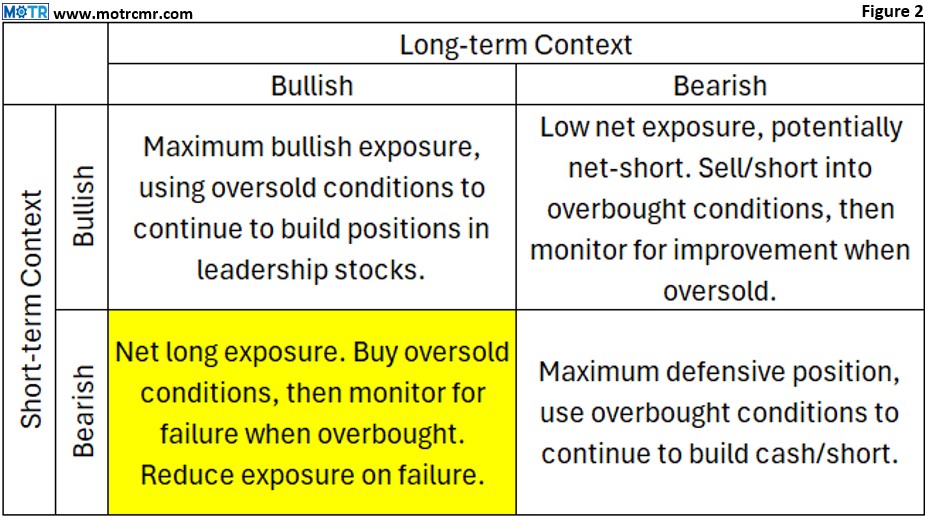

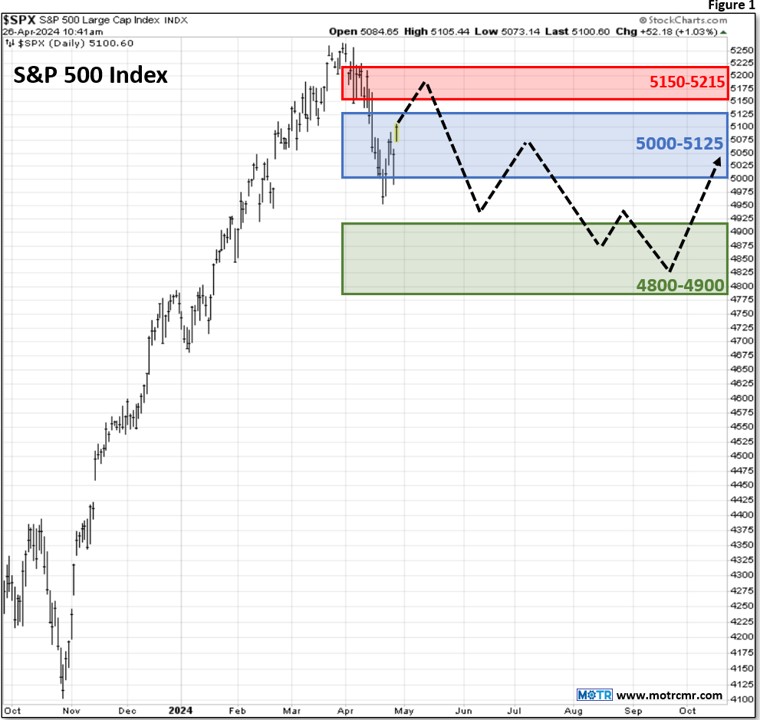

Highlights Although we are longer-term bullish, our expectations for a rangebound summer remain intact. Under such circumstances, the most important

Charting My Interruption (CMI): “A ‘Quiet Riot’ in the META-worse.”

Highlights The market's resilience despite META's disappointment confirms that it is just too oversold to make downside progress from here.

Charting My Interruption (CMI): “Winners Being Winners, Losers Being Losers.”

Highlights The correction continues to unfold in a manner comparable to most corrections in bull markets...painful, but expected. We remain