Charting My Interruption (CMI): “Yield Curve Normalization: Good or Bad For S&P?”

Highlights Like the prospect of a recession, the recent yield curve normalization has Fin-Twit all a-buzz. Predictably, the chart showing

Charting My Interruption (CMI): “I’d Want to be Long This Mystery Chart…You?”

Highlights One of the great strengths of trend following is its ability to remove bias from one's analysis. A trend

Charting My Interruption (CMI): “Weakness into Q4, Then Strength.”

Highlights For several reasons, our view remains that the S&P will see weakness through September and into the 4th quarter.

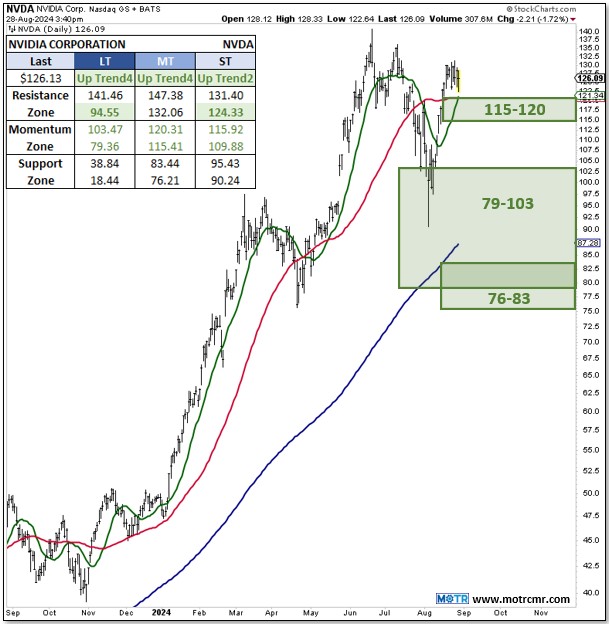

Charting My Interruption (CMI): “Levels to Watch for Nvidia (NVDA).”

"Levels to Watch for Nvidia (NVDA)." Just a quick note ahead of earnings from Nvidia (NVDA) "the Most Important Stock

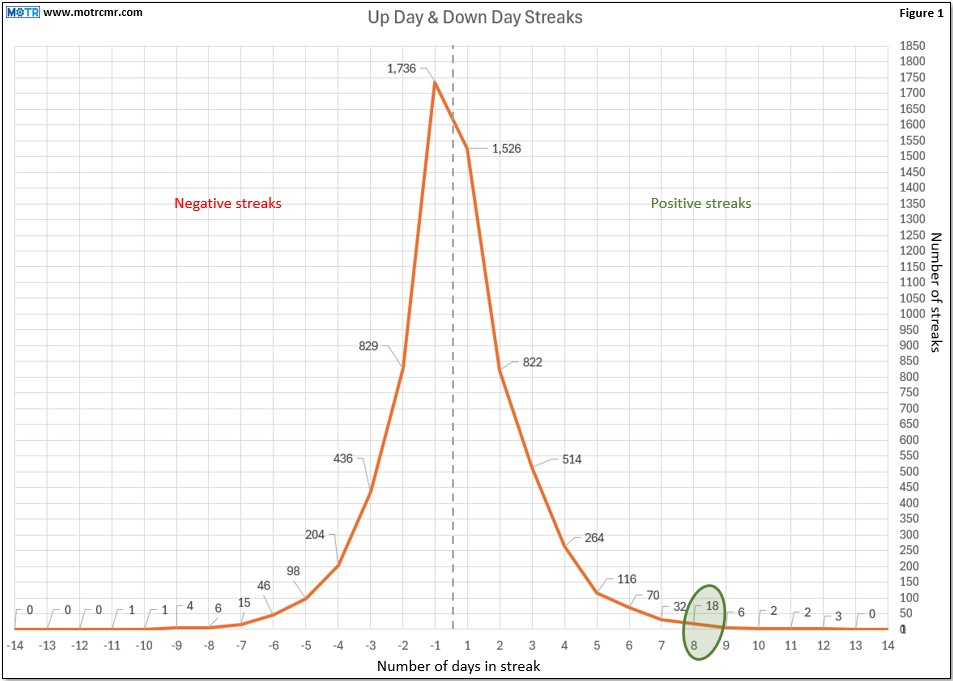

Charting My Interruption (CMI): “What Happens After a Streak(er) is ‘Arrested’?”

Highlights On Monday, the S&P ended an 8-day streak of positive returns. While not unprecedented, streaks of such duration are

Charting My Interruption (CMI): “Watch the Movie. It’s Too Late to Buy Popcorn Now.”

"Watch the Movie. It's Too Late to Buy Popcorn Now." With the market rallying so swiftly across the recent range,

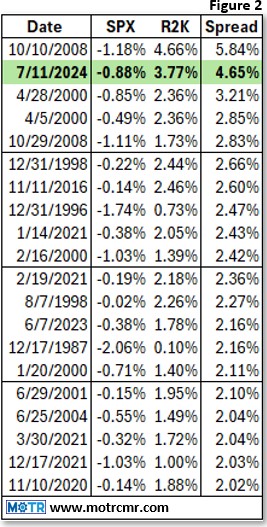

Charting My Interruption (CMI): “Apropos of the Olympics, Another Volatility Record Smashed.”

Highlights Another record spike by the VIX on Monday, following Friday's Top 20 spike, is uncomfortable but potentially boosts the

Charting My Interruption (CMI): “Next Oversold Still a Buy.”

Highlights Under the weight of the MAG7, we should expect that the S&P will make its way to its 200-day

Charting My Interruption (CMI): “The Eyeore Market–Most Likely Lose It Again Anyway.”

Highlights The Eyeore Market is one in which investors have become so accustomed to trends failing that they automatically expect

Charting My Interruption (CMI): “Bull Markets Still Have Corrections.”

Highlights Just because our Risk Gauges have finally achieved 'Risk On' for the first time since before the 2021 peak,

Charting My Interruption (CMI): “News Flash: Violent, Chaotic Behavior is not Bullish.”

Highlights As much as we all want to say yesterday's price action was bullish, I struggle to do so because

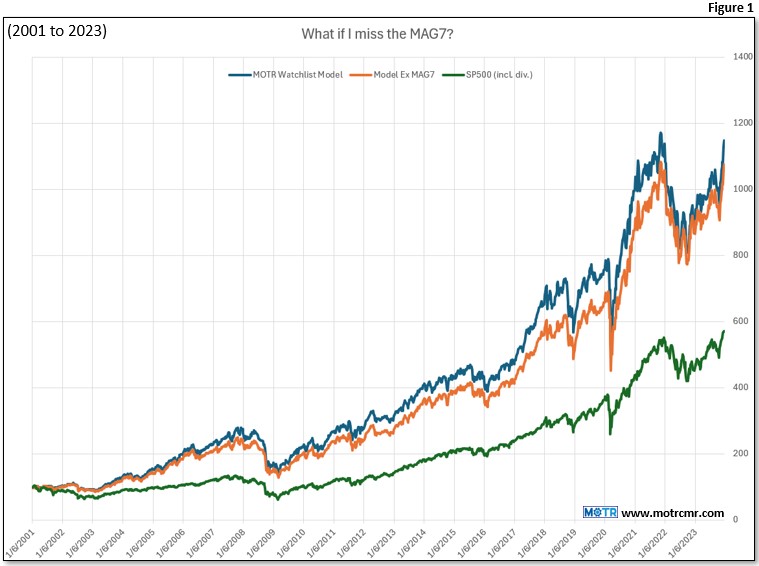

Charting My Interruption (CMI): “The Surprising Truth About Momentum & Trend Following.”

Highlights Most investors are of the impression that to do well over time as a momentum investor, one must buy