Highlights

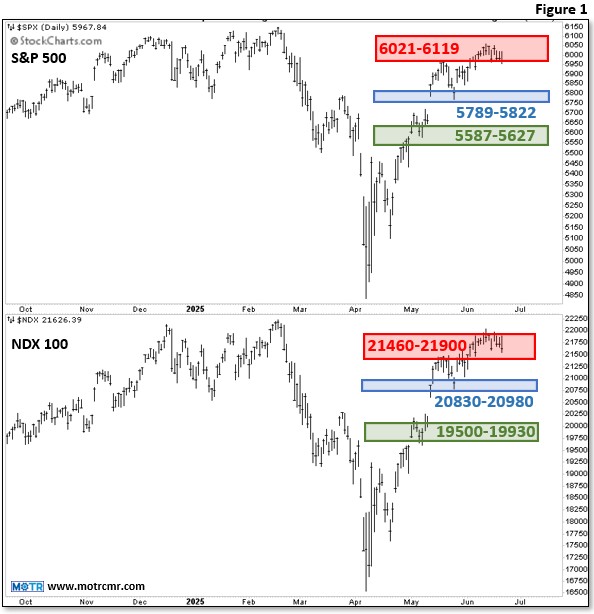

- For several reasons, our view remains that the S&P will see weakness through September and into the 4th quarter.

- However, we remain fully invested, with an eye on important supports in the 525-535 range on the SPY ETF, and a bias to be a buyer of this weakness.

- Our Risk Gauge is teetering on "Risk On" across all three timeframes, which sets the stage for higher prices in time, warranting a "dip buying" mentality.