Highlights

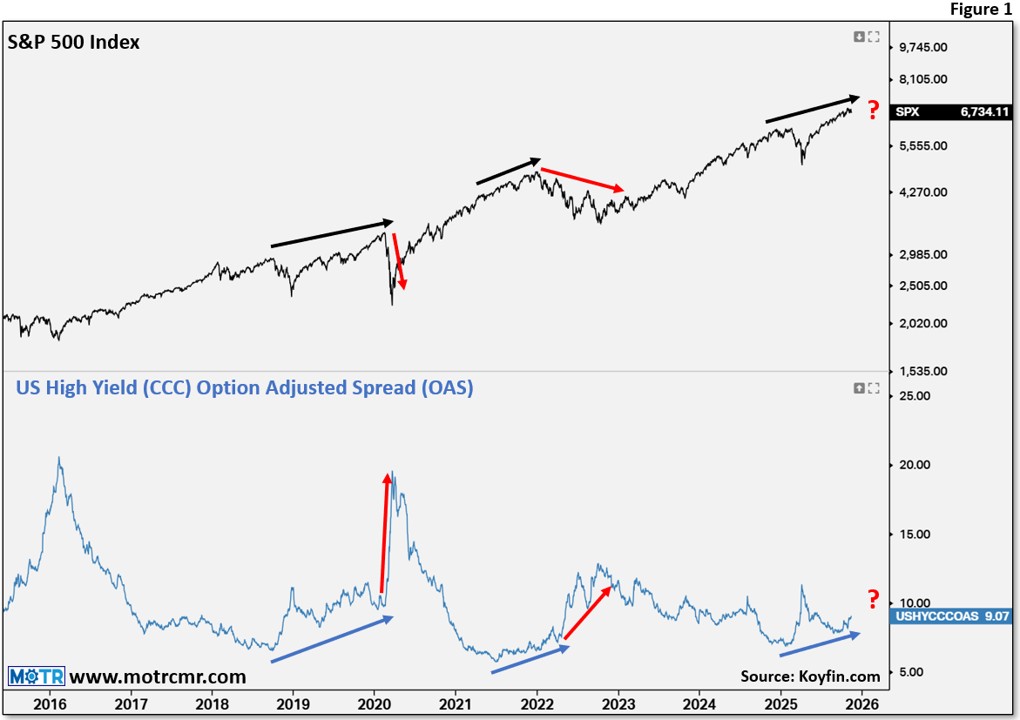

- Cooling PPI and core PPI give more signals that the Fed will likely cut rates next week, and lower treasury yields inform us that the market endorses the idea.

- At the same time, current market conditions continue to follow the "bubble" script, including, among others, extreme valuations and rapid increases in highly speculative names.

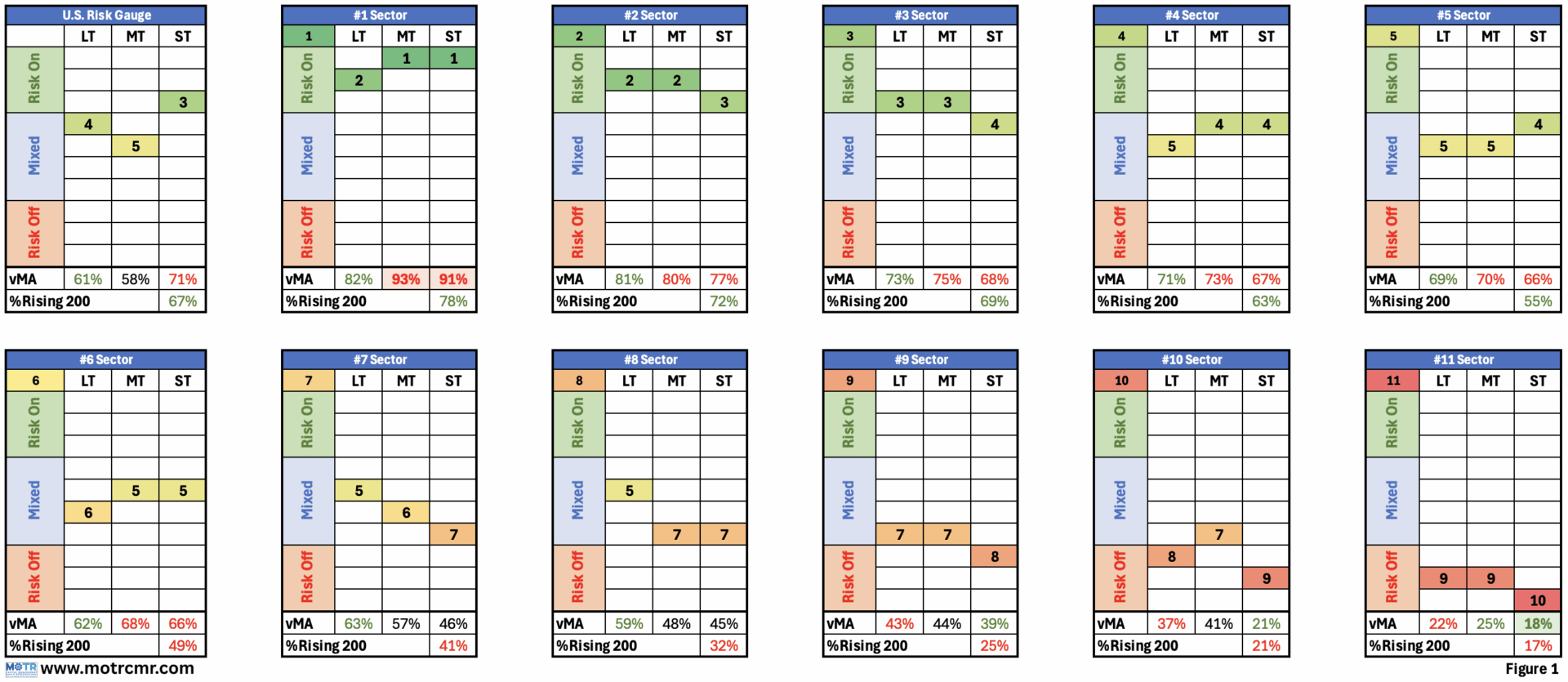

- The backdrop to all of this is still a highly divergent market, so this doesn't change our skeptical long-term view.

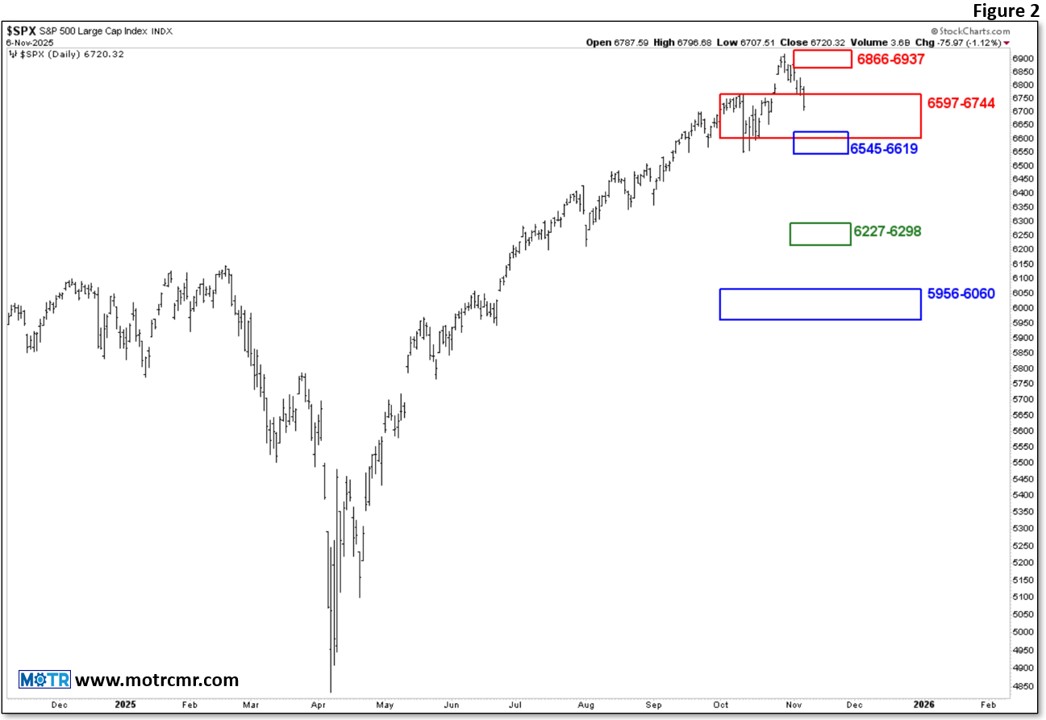

- That said, rather than ignore or. . .