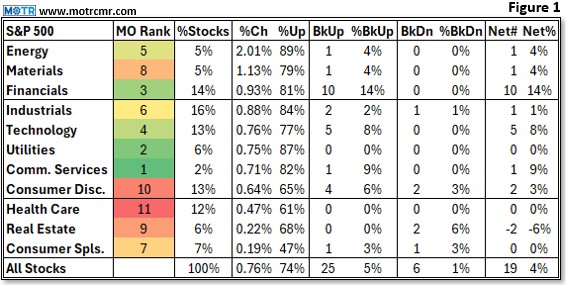

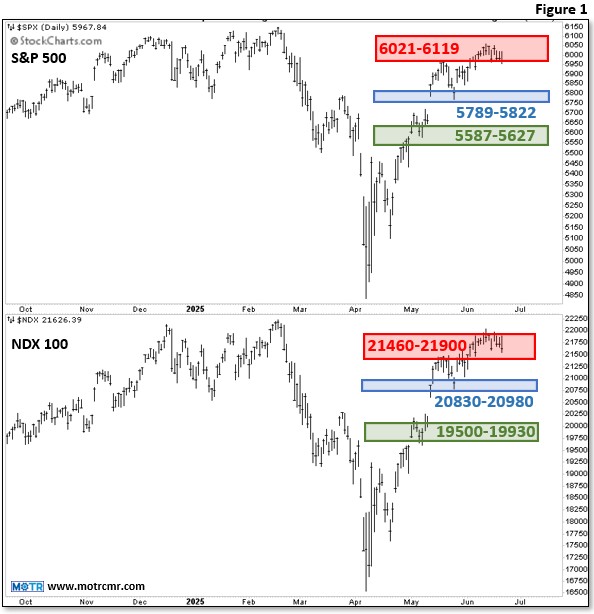

The market's internals reflect a lot more awareness about ongoing macro weakness than most media outlets, and the S&P frankly, would like us to believe. Still, leadership remains very cyclical. What to do? We discuss this and more in this month's Monthly MOTR Checkup video. . .