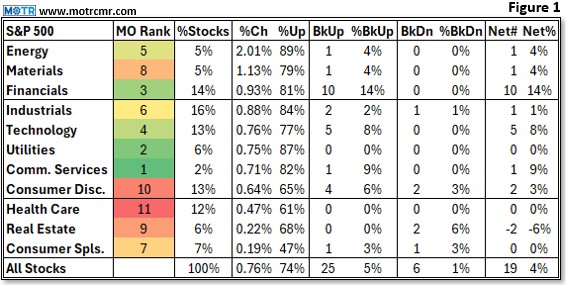

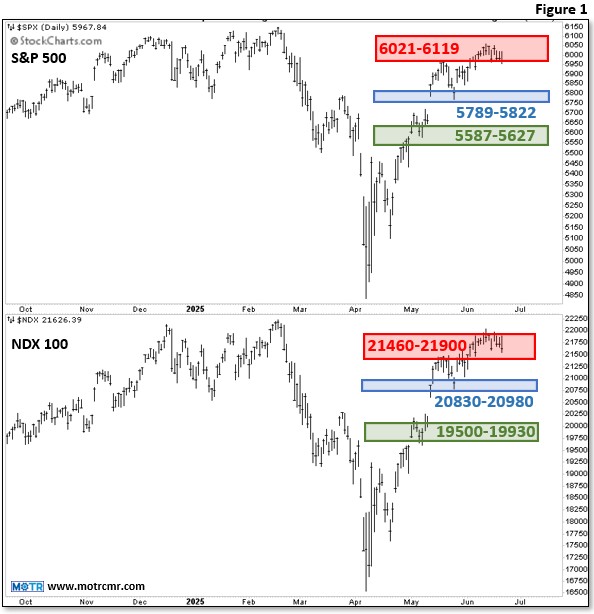

With the S&P moving higher after reaching an oversold condition in October, the bulls now need to convert this bounce into constructive trend change. If they can, we'll keep what we bought in October, and add more. If not, we'll reduce longs and restore shorts. We discuss what we are monitoring for indications of trend change, plus a whole lot more, in this month's Monthly MOTR Checkup video. . .