Are you positioned correctly for the next market move?

The MOTR Risk Gauge, built on principles that have guided investors through bull and bear markets for over 35 years, provides unbiased clarity in a noisy investment landscape. Here’s where it stands for the upcoming month…

Monday, January 5th, 2026 – While the calendar has changed, our approach has not. Rather than anchoring to year-long forecasts, we continue to rely on the MOTR Risk Gauge to provide objective context for the environment we are actually operating in.

The latest U.S. Risk Gauge marks a notable improvement at the long-term level, finishing the year in ‘Risk On’ with a reading of 3, while both the medium- and short-term gauges sit in the upper half of ‘Mixed’. Importantly, this represents progress from December, when all three timeframes resided in ‘Mixed’ territory. Ending the year with the long-term trend in ‘Risk On’ is meaningful, as it confirms that the primary trend is strong despite recent volatility and holiday-related selling pressure.

Leadership has also remained remarkably consistent. Technology continues to dominate the upper ranks of the MOTR Group board, with Semiconductors, Clean Energy, and IT Hardware maintaining strong momentum. Health Care remains the top-ranked sector, led by Biotech and Pharma, alongside continued improvement in Health Care Equipment and Services. Outside of those sectors, relative strength can still be found inside Precious Metals, Industrial Metals, Capital Goods, Banks, and Transports, reinforcing the message that leadership is not narrowing, but broadening as supported by the improvements seen in the Risk Gauge.

With that backdrop, our positioning remains unchanged. We are long leadership where trends remain constructive, while maintaining flexibility and discipline should conditions deteriorate. While we recognize that this environment is a bubble, the Risk Gauge continues to support staying engaged on the long side until the data signals otherwise.

As always, the Risk Gauge is descriptive, not predictive. For now, it continues to describe a market where the long-term trend is positive, pullbacks are being absorbed, and leadership remains intact. We will stay aligned with that message and adjust only when the data demands it.

If you’d like to stay up to date with us as we watch and analyze where the market goes from here, sign up below to get future Monthly Risk Gauge Updates delivered straight to your inbox for free.

Want more than monthly updates?

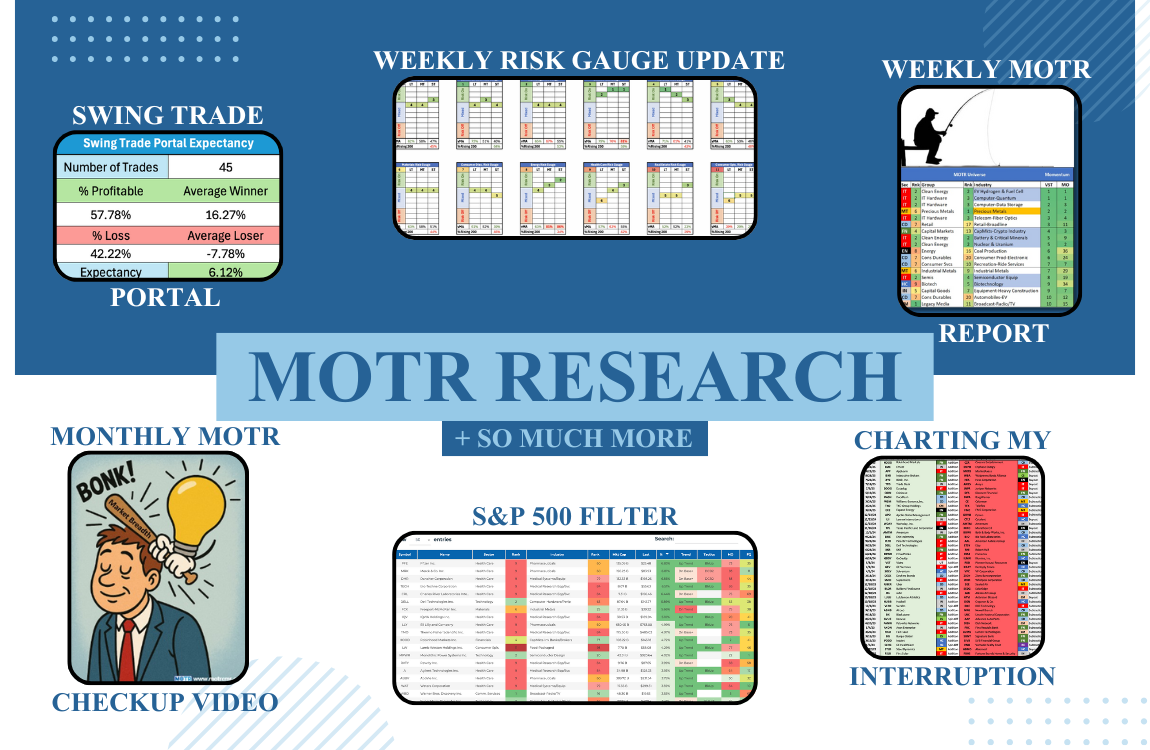

Start your 1-month free trial with MOTR Research and unlock weekly US equity reports, the Weekly Risk Gauge Update for all 11 sectors, access to our Swing Trade Portal, Monthly Checkup videos, and much more!