Highlights

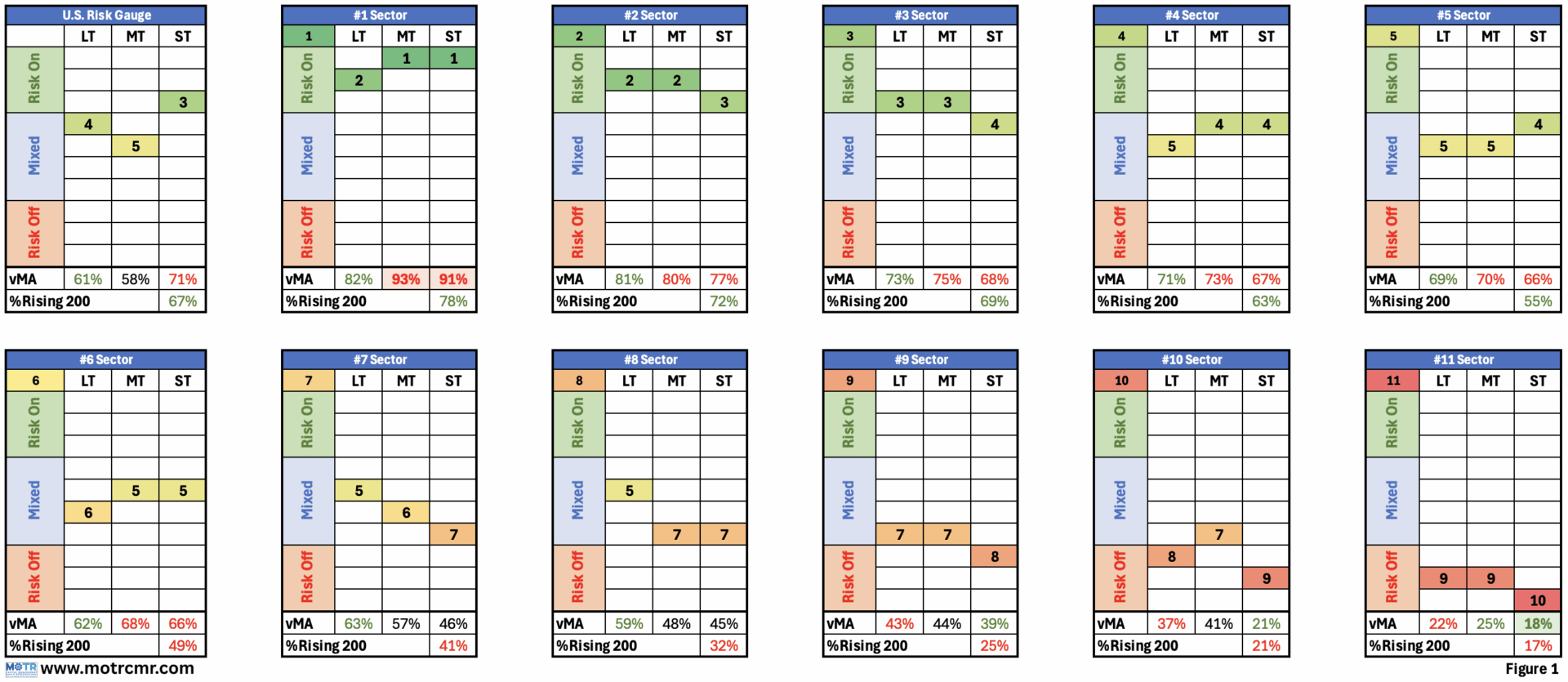

- We monitor marginal shifts in leadership to adapt exposures gradually rather than making abrupt regime bets.

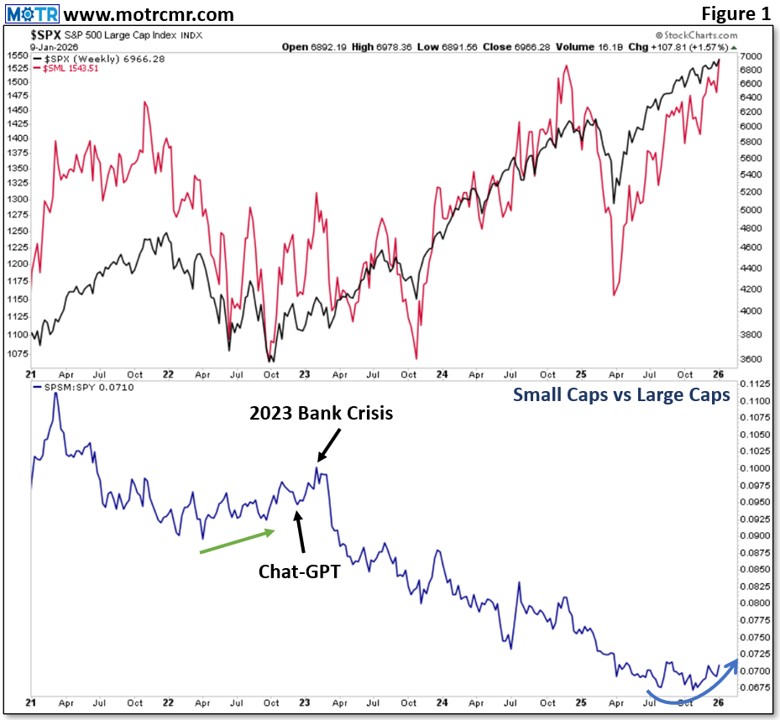

- Recent rotations include improving Biotech, weakening MAG7, renewed strength in Quantum, Crypto, Clean Energy, and late‑cycle groups like Transports, Metals, and Banks.

- Although very nascent, recent surges by late-cycle Chemicals and defensive Staples may prove to be important in time, aligning with our view that 2026 could mark the peak and unwinding of the AI bubble.

- Portfolios remain 'Risk‑On' overall, with small “scout. . .