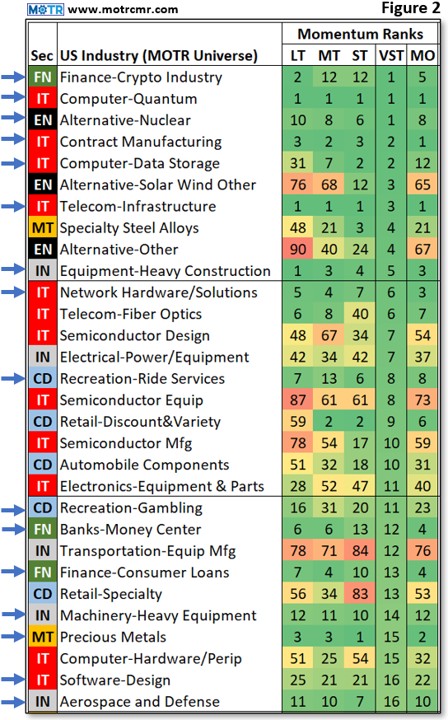

Highlights

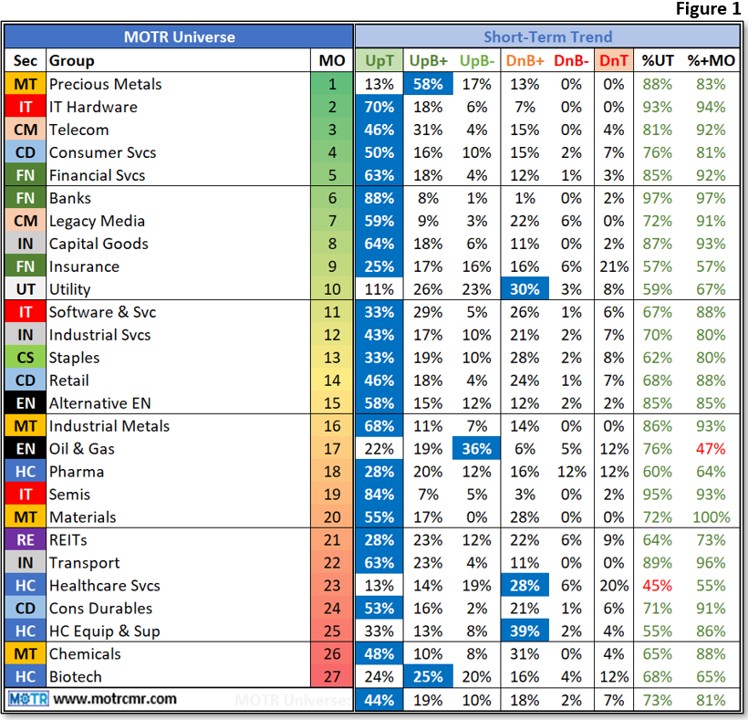

- With the S&P a mere 1% below its recent all-time high, one might be surprised to discover that there is a rather extensive correction going on beneath the surface.

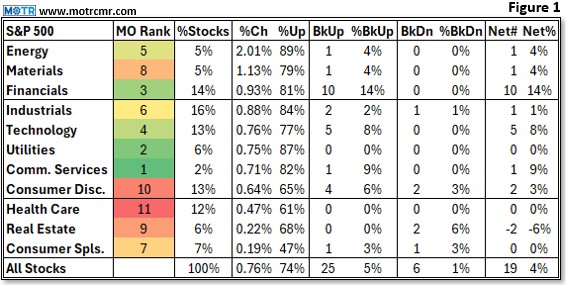

- The MOTR Risk Gauge, which we consider to be our truth serum, has been deteriorating in the short-term for about a week now, revealing a stealth correction underway.

- In addition, the equally weighted S&P ETF (RSP) is set to record its 10th consecutive. . .