Charting My Interruption (CMI): “A ‘Quiet Riot’ in the META-worse.”

Highlights The market's resilience despite META's disappointment confirms that it is just too oversold to make downside progress from here.

Charting My Interruption (CMI): “Winners Being Winners, Losers Being Losers.”

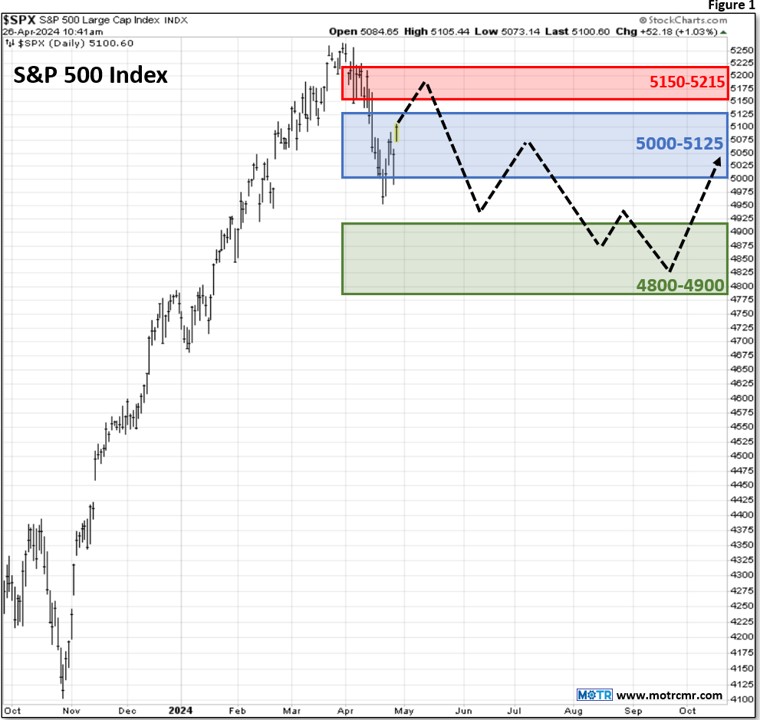

Highlights The correction continues to unfold in a manner comparable to most corrections in bull markets...painful, but expected. We remain

Charting My Interruption (CMI): “Time For Some Pain?”

With stocks selling off today, the natural question might be "is this it? Are we about to get slammed?" I

Charting My Interruption (CMI): “Good News, There’s More Resistance Ahead.”

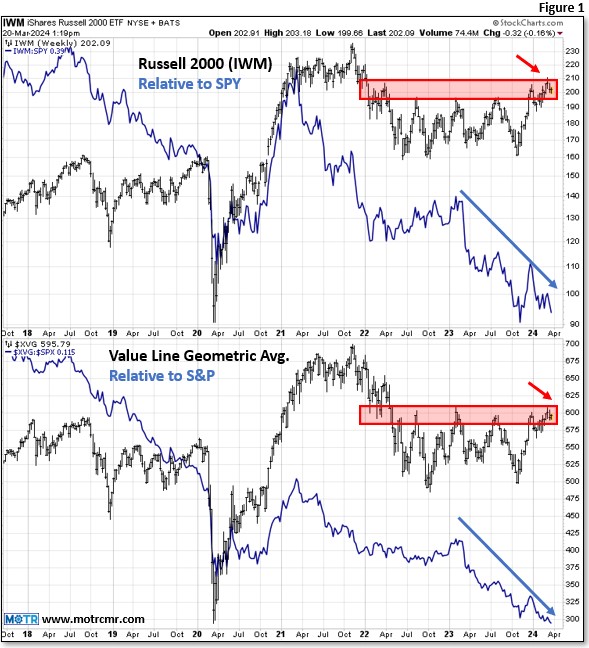

Highlights The Value Line Geometric Average finally broke above overhead resistance, a battle we have been chronicling for nearly two years

Charting My Interruption (CMI): “Small-cap Leadership, if it Manifests, Would be Uber Bullish.”

Highlights Small caps have been stubbornly underperforming large-caps, leaving us with a lingering concern that our bullish call is not

Charting My Interruption (CMI): “Much Ado About 40x EV to Sales?”

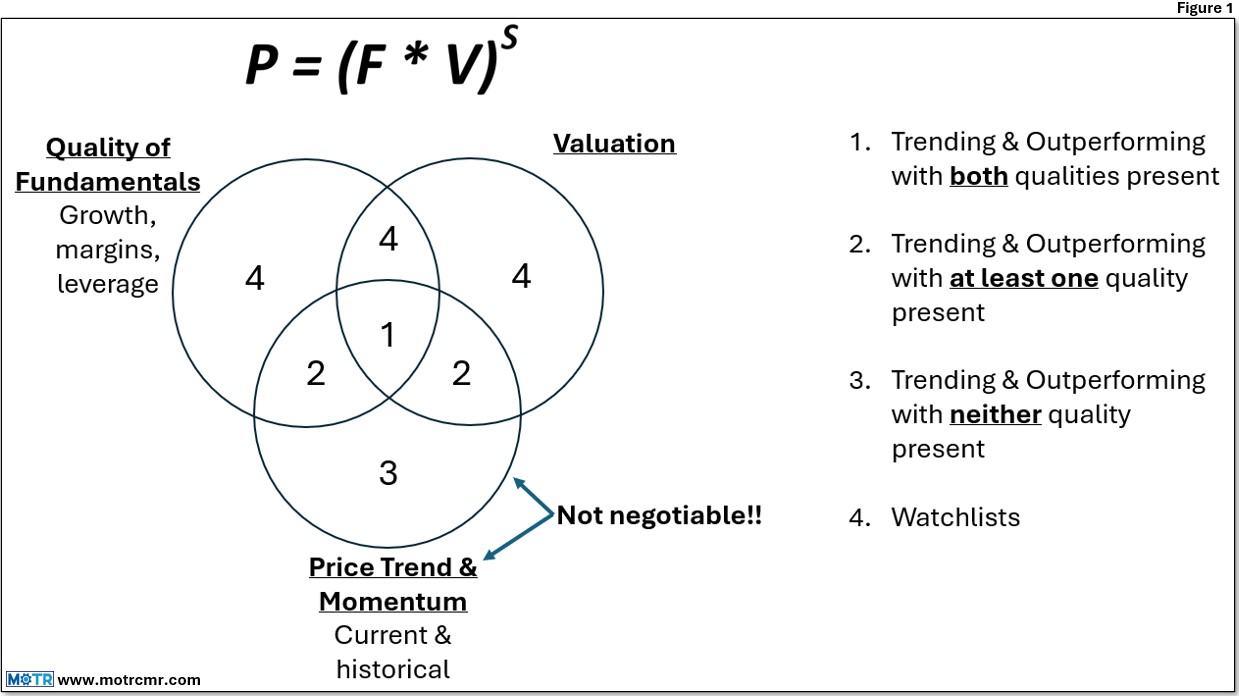

Highlights Wonderful things happen when you can be on the right side of fundamental growth and valuation expansion. Recognizing that

Charting My Interruption (CMI): “The Aftermath of Big Down Days.”

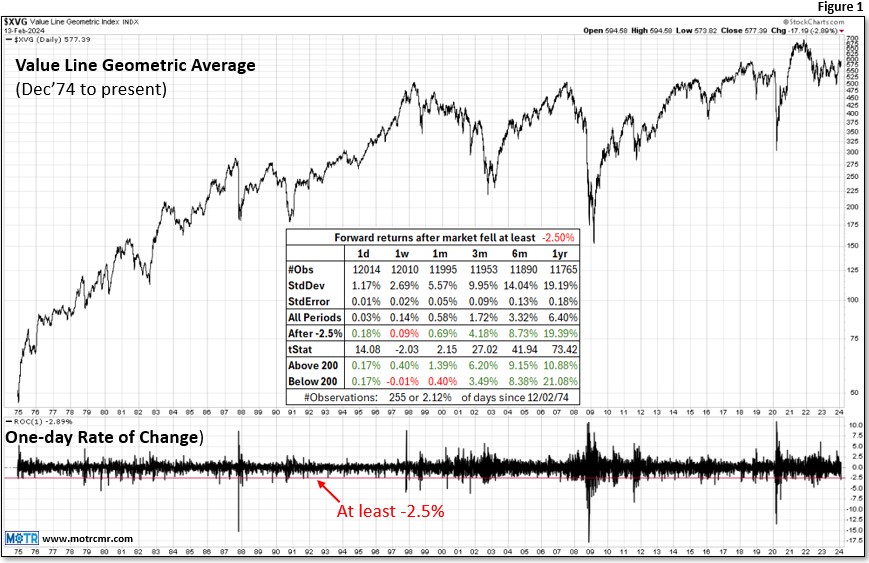

Highlights The average stock has fallen by at least -2.5% on a single day only 255 times since 1974 (2.12%

Charting My Interruption (CMI): “Growth in Driver’s Seat…Sort of.”

Highlights Large cap growth is at new highs vs value, but small cap growth is a far cry from the

Charting My Interruption (CMI): “Winds of Change Since the October Lows.”

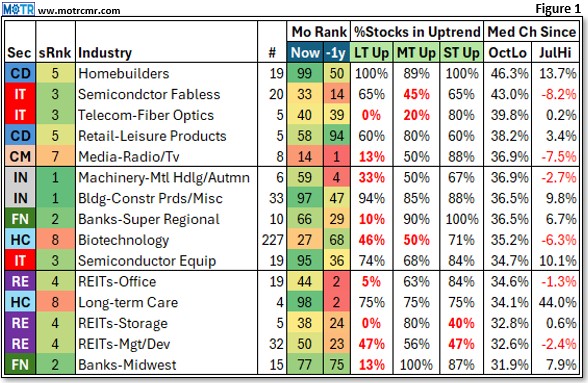

Highlights Since last October's low, the median gain for the 2600 stock MOTR Universe is about +16%. Since that low,

Charting My Interruption (CMI): “A 10yr Yield Above 4.25% Would Be Disruptive for Stocks.”

Highlights The US 10 year yield looks set to recover back above 4.50% in the weeks ahead, in line with

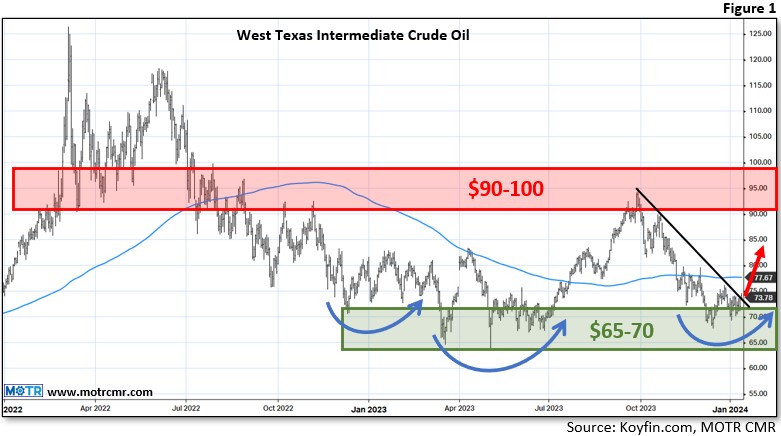

Charting My Interruption (CMI): “What if Oil, Rates, and the USD Rally?”

Highlights Oil looks set to make a run at $100 again, likely in tandem with higher 10 year yields, and

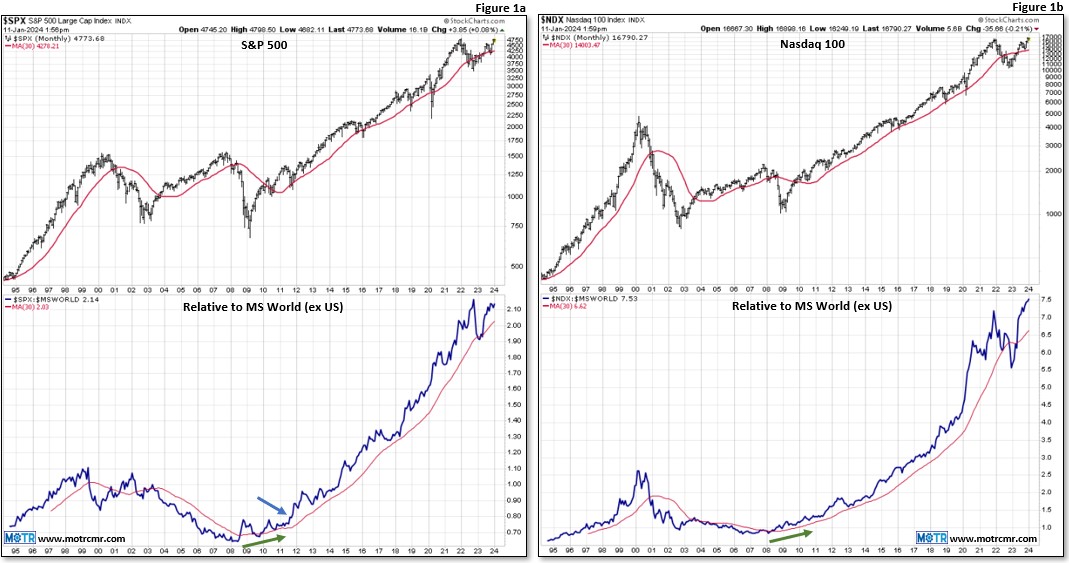

Charting My Interruption (CMI): “If Not U.S., Then Where?”

"If Not U.S., Then Where?" Many questions abound as we embark on another year of investing. Ranging from geopolitics and