Highlights

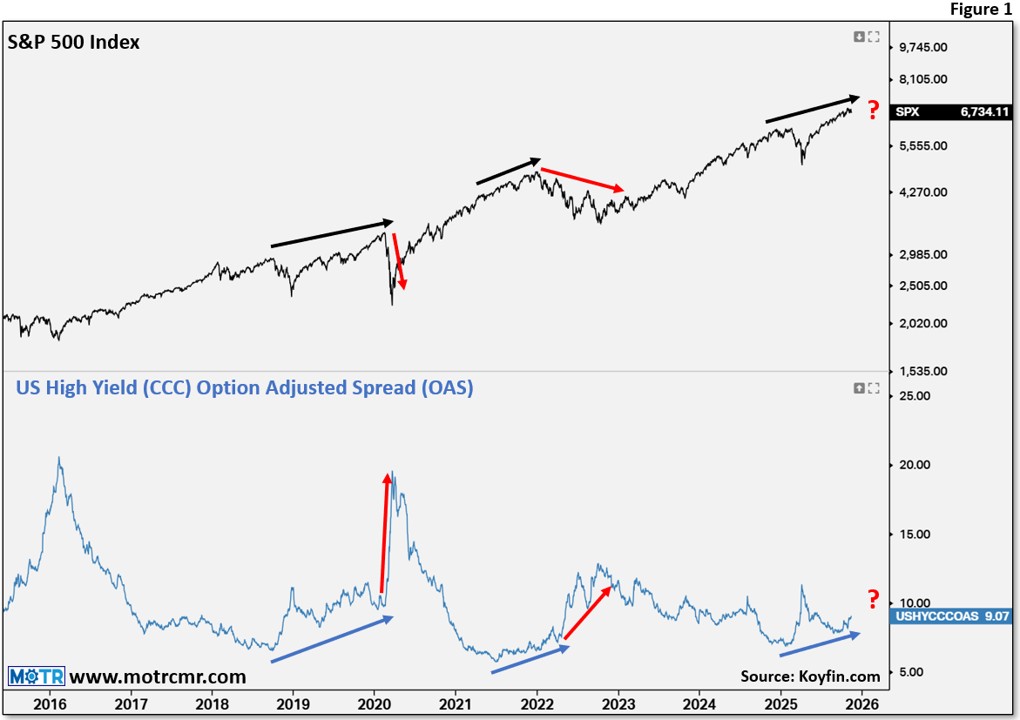

- On Monday, the S&P ended an 8-day streak of positive returns. While not unprecedented, streaks of such duration are not necessarily all that common either.

- The good news is that following streaks of similar duration since 1970 (there have been 18 in total), forward returns have tended to be positive.

- The bad news is that they have tended to be below average compared to any random period of returns.

- With market structure still 'good and getting. . .