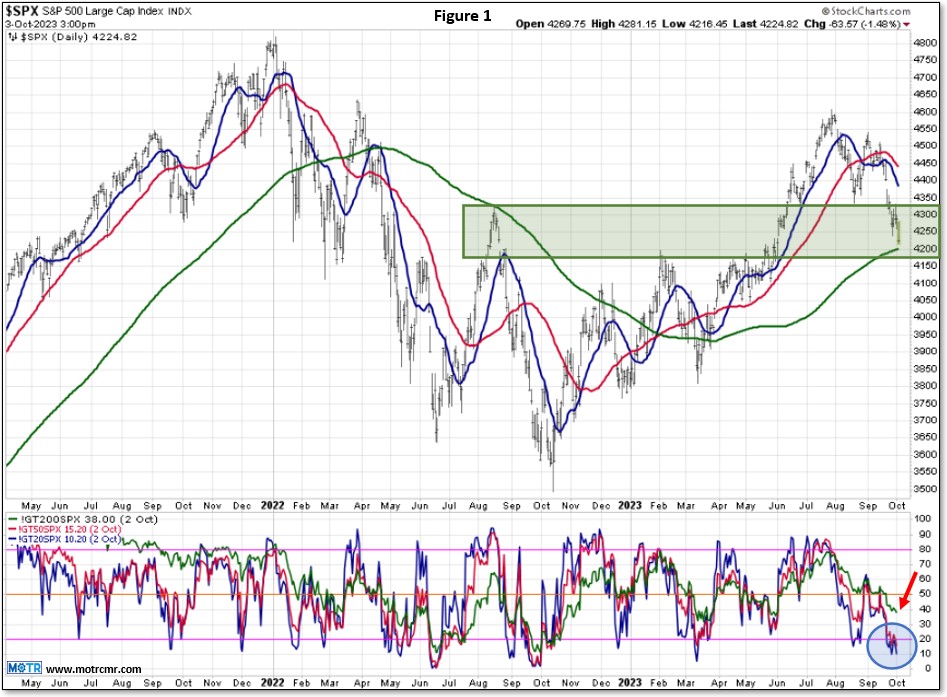

For all intents and purposes, the S&P has now reached its 200 day average after peaking in July. In so doing, it has fully tested the 4200 to 4300 support zone we have been keying off of since that peak (Figure 1).

For all intents and purposes, the S&P has now reached its 200 day average after peaking in July. In so doing, it has fully tested the 4200 to 4300 support zone we have been keying off of since that peak (Figure 1).

While we were expecting a pullback, we were clear that it needed to be orderly, or we'd run the risk of the already very fragile market structure coming unglued. . .