Post the latest Fed rate meeting and briefing, the market remains under pressure. While a test of the 4200 area was part of our gameplan before we thought we'd see a chance of a bull trend resumption, we also want to track important support areas for more specific sectors and factors within the market, since a widespread failure to hold comparable supports will bring into question the S&P's ability to hold at 4200. In that light, Figure 1 provides a snapshot of important ETFs, along with the constituents of our

Charting My Interruption (CMI): “Critical supports to monitor in the days & weeks ahead.”

September 21st, 2023

Related Market Insights

Some of Our Latest Commentary

Monthly MOTR Checkup Video (MMC): “Appear strong when you are weak and weak when you are strong.”

After spending nearly two years appearing to be strong when it was weak, the market may be transitioning to a

July 24th, 2024

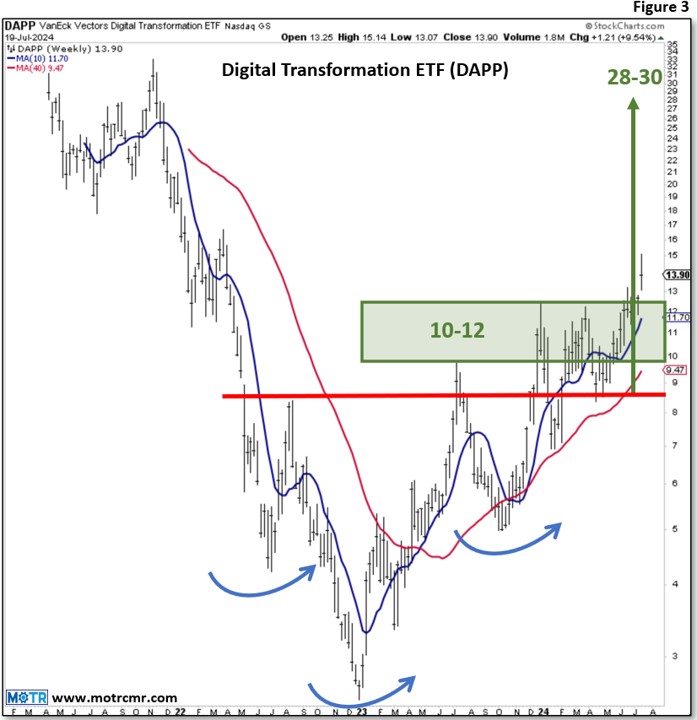

Weekly MOTR Report (WMR): “Crypto & Crypto Stocks Leading the Way.”

Highlights As the S&P takes a pause, burdened by a near -10% setback in NVDA last week, crypto and crypto

July 22nd, 2024

Charting My Interruption (CMI): “Bull Markets Still Have Corrections.”

Highlights Just because our Risk Gauges have finally achieved 'Risk On' for the first time since before the 2021 peak,

July 18th, 2024

Weekly MOTR Report (WMR): “Robust Bull Market Finally Getting Closer.”

Highlights In Friday's CMI note, we said we needed to see an improvement in our trend model readings before spinning

July 15th, 2024

Charting My Interruption (CMI): “News Flash: Violent, Chaotic Behavior is not Bullish.”

Highlights As much as we all want to say yesterday's price action was bullish, I struggle to do so because

July 12th, 2024

Weekly MOTR Report (WMR): “Bullish, But Cautiously So.”

Highlights Market conditions continue to diverge, with leadership itself getting more and more narrow. Whether or not this is a

July 08th, 2024