Weekly MOTR Report (WMR): “Crypto & Crypto Stocks Leading the Way.”

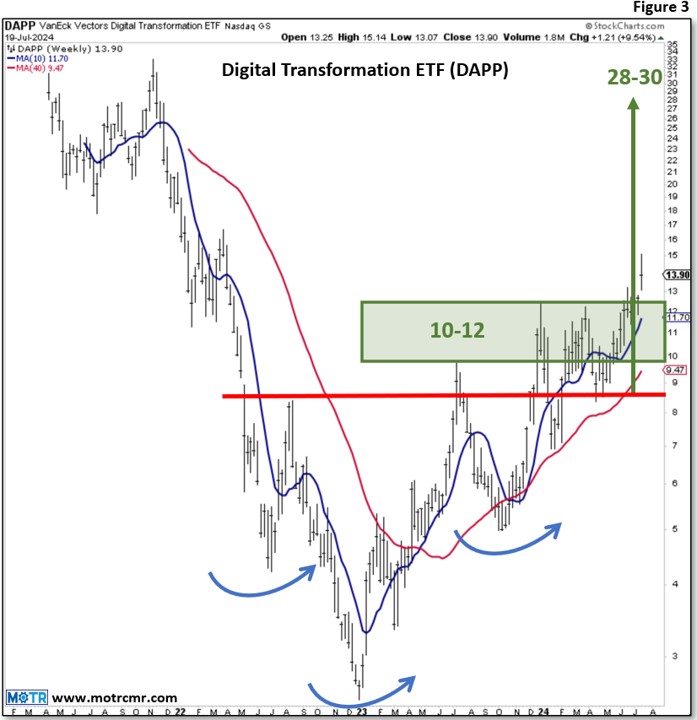

Highlights As the S&P takes a pause, burdened by a near -10% setback in NVDA last week, crypto and crypto

Weekly MOTR Report (WMR): “Robust Bull Market Finally Getting Closer.”

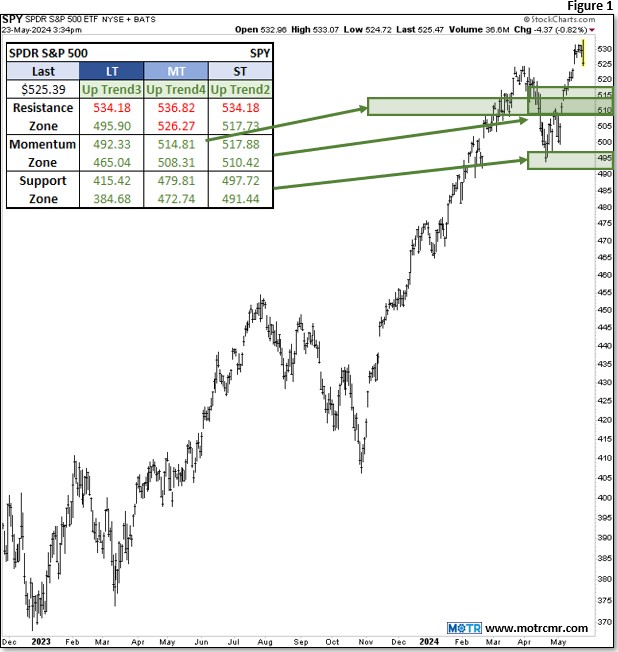

Highlights In Friday's CMI note, we said we needed to see an improvement in our trend model readings before spinning

Weekly MOTR Report (WMR): “Bullish, But Cautiously So.”

Highlights Market conditions continue to diverge, with leadership itself getting more and more narrow. Whether or not this is a

Weekly MOTR Report (WMR): “The ‘Haves’ and the ‘Have-Nots’ Grow Further Apart.”

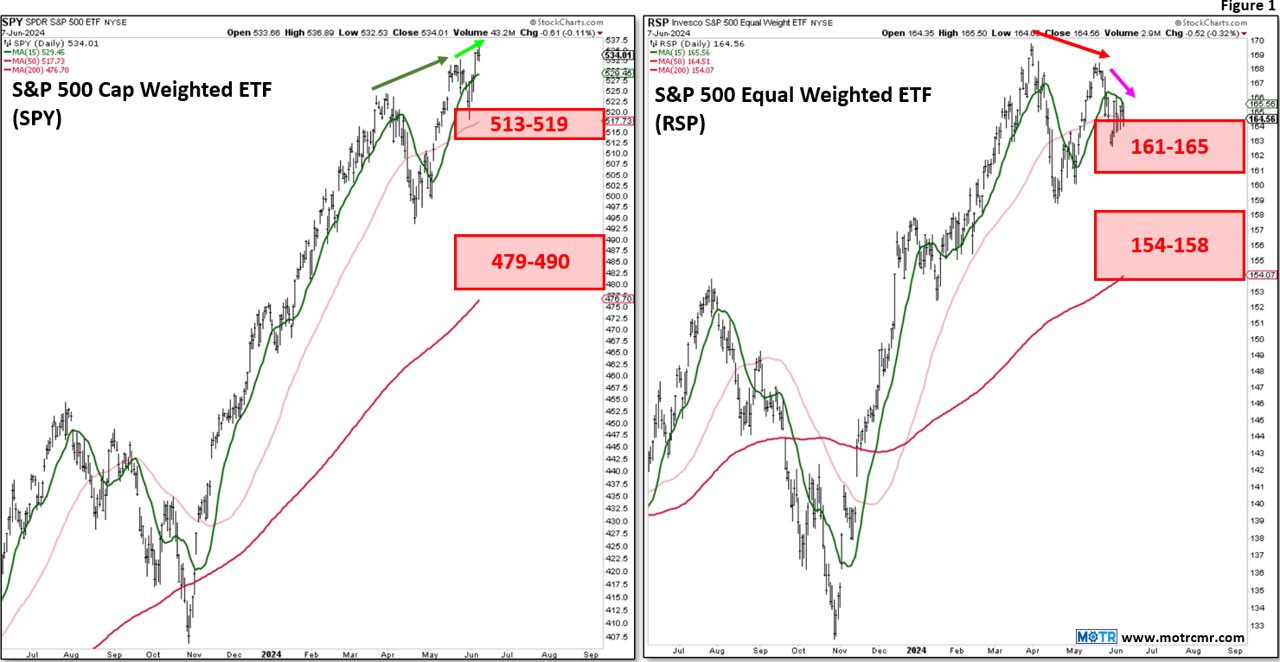

Highlights Despite the strong showing by the S&P ETF (SPY) last month (+3.4%), the average stock was actually down over

Weekly MOTR Report (WMR): “More Potholes on Backroads Than Highways.”

Highlights Since March, our commentary has been focused on the narrowing character of market breadth, and the prospects for a

Weekly MOTR Report (WMR): “Even the NDX is Running Low on Fuel.”

Highlights The small and mid-cap indices fumbled their opportunity to catch up to the big boys last week, giving up

Weekly MOTR Report (WMR): “Conditions for a Correction Remain in Place.”

Highlights Short-term divergences continue to build, adding to our conviction that aggressive buying is ill-advised while the market is overbought.

Weekly MOTR Report (WMR): “Consumer Stocks Stepping in to Fill Tech’s Void.”

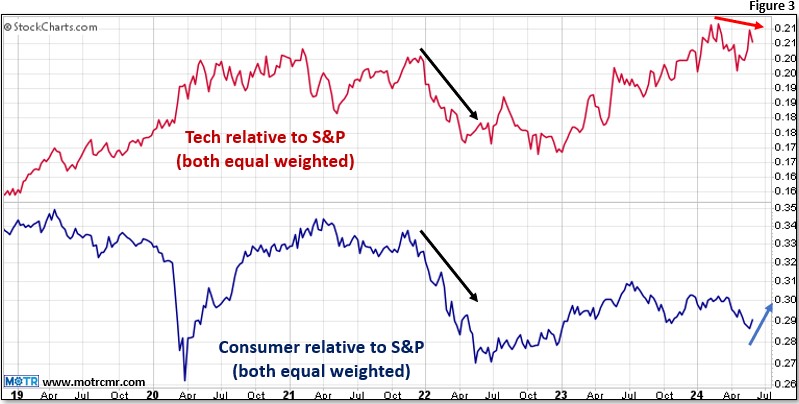

Highlights On Friday, the S&P left the impression it was intent on going higher, but drilling down on the day's

Weekly MOTR Report (WMR): “Preference for Buying Next Oversold.”

We just published our Monthly MOTR Checkup Video, titled "Market Not Ready for 'Prime' Time Yet" (here). The high level summary points

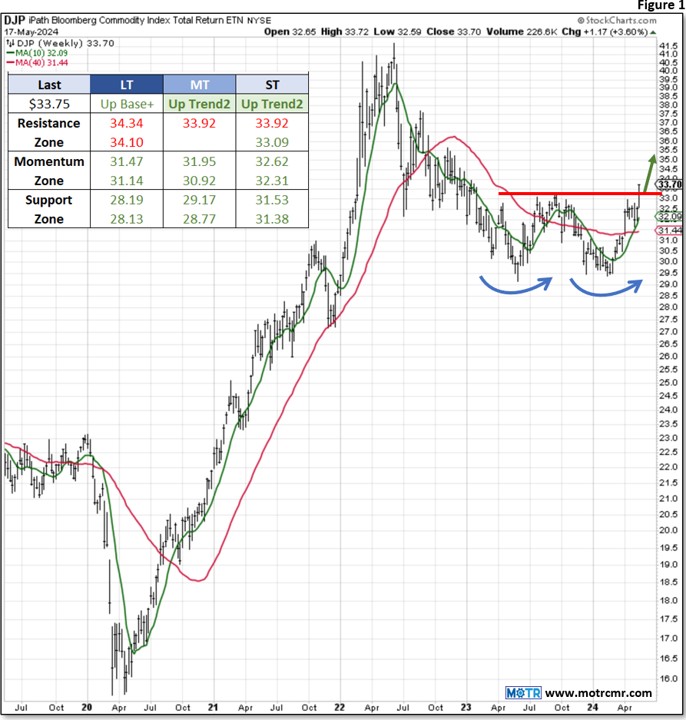

Weekly MOTR Report (WMR): “Commodities Breaking Out…Don’t Ignore.”

Highlights With all eyes on NVDA this week, let's not lose sight of last week's big reversal in commodities. While

Weekly MOTR Report (WMR): “Tactical Caution Still Warranted.”

Highlights We remain longer-term bullish, with expectations for further gains towards the latter part of 2024. That said, no trend

Weekly MOTR Report (WMR): “Outlook for a Rangebound Summer Remains Intact.”

Brief note this week as I am traveling for my son's college graduation! While it has been nice to see