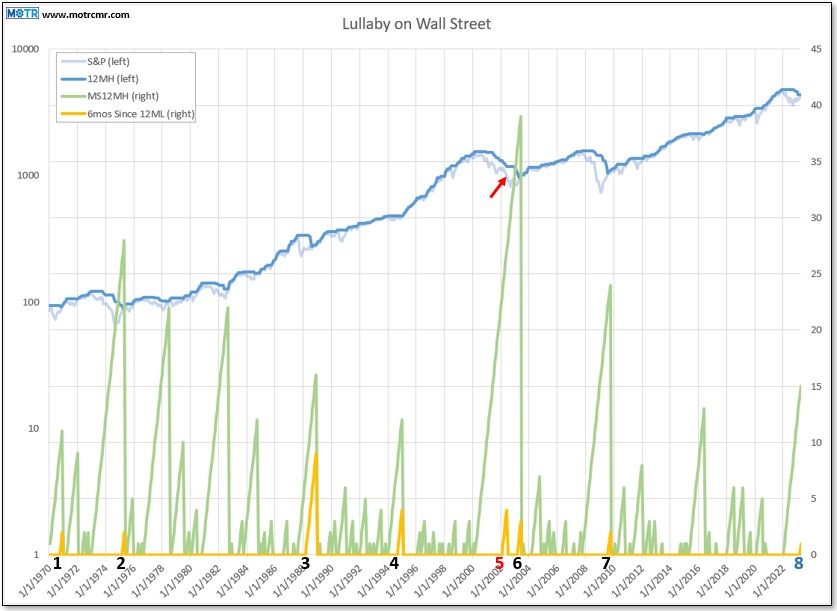

Its been 15 months since the S&P has hit a 12 month high. While this is clearly not good for the bulls, such lack of upward progress isn't necessarily good for the bears, either. The current case is a good example, in that it has also been 6 months since the S&P has hit a 12 month

Its been 15 months since the S&P has hit a 12 month high. While this is clearly not good for the bulls, such lack of upward progress isn't necessarily good for the bears, either. The current case is a good example, in that it has also been 6 months since the S&P has hit a 12 month

Charting My Interruption (CMI): “Lullaby on Wall Street”

April 21st, 2023

Related Market Insights

Some of Our Latest Commentary

Weekly MOTR Report (WMR): “Correction Underway, Tactical Rally Due.”

The Monthly MOTR Checkup Video was published last night, so today's WMR will be brief. In essence, the correction is

April 22nd, 2024

Monthly MOTR Checkup Video (MMC): “The ‘Beauty & the Beast’ of Trend Following.”

Corrections are a necessary evil of healthy uptrends--they reset expectations, and flush out bullish sentiment, setting the stage for the

April 22nd, 2024

Charting My Interruption (CMI): “Winners Being Winners, Losers Being Losers.”

Highlights The correction continues to unfold in a manner comparable to most corrections in bull markets...painful, but expected. We remain

April 17th, 2024

Weekly MOTR Report (WMR): “Selling Begets Buying in Bull Markets.”

Highlights The correction is well underway now, with the Value Line (average stock) already down over 5% from its recent

April 15th, 2024

Weekly MOTR Report (WMR): “Tech Pausing, Energy & Materials Picking Up Slack.”

Highlights The Tech sector continues to languish, with breadth deterioration taking hold despite continued new highs in 2024 for the

April 08th, 2024

Charting My Interruption (CMI): “Time For Some Pain?”

With stocks selling off today, the natural question might be "is this it? Are we about to get slammed?" I

April 02nd, 2024